Expert Voices

Expert Voices

“Carbon neutrality” refers to the goal of reducing actual carbon dioxide (CO2) emissions to zero (0) by taking countermeasures to absorb as much CO2 as is emitted. In a report published in 2018, the Intergovernmental Panel on Climate Change (IPPC) predicted that the average global warming would climb above 1.5°C from 2035 to 2052, compared to the pre-industrial era. It also indicated that if we limit the average global temperature rise to 1.5°C or less, we can significantly lessen unfavorable consequences by keeping it below 2°C. It was also suggested that having Net Zero is required to manage the temperature rise to less than 1.5°C. Many governments have since declared their commitment to carbon neutrality. The Korean government also declared carbon neutrality in October 2020, and in December 2020, it unveiled the “2050 Carbon Neutrality Implementation Strategy.”

Carbon dioxide emissions in the petroleum and gas sectors can be broadly divided into two categories: emissions generated during the corporation’s manufacturing process and emissions emitted during the consumption of produced fuels. The amount of emissions accounted for by these industries can be broken down into 9 % from the manufacturing process and 22 % from the consumption process, for a total of 42 %.(1) In order to meet the climate change objective of limiting average global warming to 1.5°C, emissions must be reduced by 3.4 gigatonnes per year by 2050. It equates to roughly 90% of current emissions levels. Carbon dioxide emissions can be lowered in three ways: reducing energy consumption by improving energy efficiency, converting energy from fossil fuels such as petroleum and gas to renewable energy, and carbon capture and storage (CCS), which captures and stores carbon dioxide emitted during the development and use of fossil fuels.

When examining the carbon reduction strategies of major oil businesses (global oil companies), it is clear that European and American companies are heading in opposite paths. The European circle, which includes BP, Shell, and Total Energies, places a strong emphasis on bolstering renewable energy business, whereas the American circle, which includes ExxonMobil and Chevron, focuses on their existing oil business while attempting to reduce carbon emissions through methods such as CCS.

Among European companies, BP was the first to express its intention to go carbon neutral by 2025 in 2020 and proposed a clear direction. BP revealed a plan to cut its oil and gas production by 40% and generate 50GW(gigawatt) of renewable energy.(2) On the other hand, ExxonMobil, an American company, beefs up CCS technology, which captures and stores carbon dioxide, and strives to develop advanced biofuel technology. ExxonMobil plans to invest USD 100 billion (roughly KRW 117.8 trillion) in a CCS project in the Gulf of Mexico that will capture and isolate millions of tons of carbon.(3) Chevron also concentrates on the CCS business. The reason for this disparity between American and European major oil firms appears to be a difference in their business environments. American major oil companies get the upper hand in oil business operations such as reserve volumes, accessibility to available oil fields, the size of secured markets, and other factors over their European counterparts.

(3) Source : EI, Oil Daily, Nov. 17, 2021.

The government-managed companies in oil producing countries are adjusting their business to lessen carbon. The United Arab Emirates (UAE) was the first in the Middle East to declare its commitment to carbon neutrality. With the objective to attain Net Zero emissions by 2050, the UAE’s national corporation ‘ADNOC’ plans to develop renewable energy at a scale of 30GW by 2030.(4) In October, Saudi Arabia also announced its decision to achieve carbon neutrality by 2060. Aramco, Saudi Arabia’s state enterprise, is undertaking a project to generate green hydrogen(5) using water electrolysis from renewable energy starting in 2025. To be more specific, the project intends to produce 650 tons of green hydrogen per day, which will be converted into green ammonia via the ammonia synthesis process and exported.(6) The UAE and Saudi Arabian national oil firms have already produced and exported blue hydrogen.(7)

(4) Source : EI, Petroleum Intelligence Weekly, Nov. 26, 2021.

(5) Green hydrogen: It refers to hydrogen produced by the electrolysis of water. It is created by electrolyzing water with electricity generated by solar or wind power. In a nutshell, green hydrogen is a type of hydrogen that emits no carbon emissions during the manufacturing process. – Source : Korea Economy Economic Dictionary

(7) Blue hydrogen: refers to hydrogen produced through a minimized carbon emission process in which carbon generated during the extraction of gray hydrogen is captured and stored, or, caught by applying a carbon capture, utilization and storage (CCUS) technology.

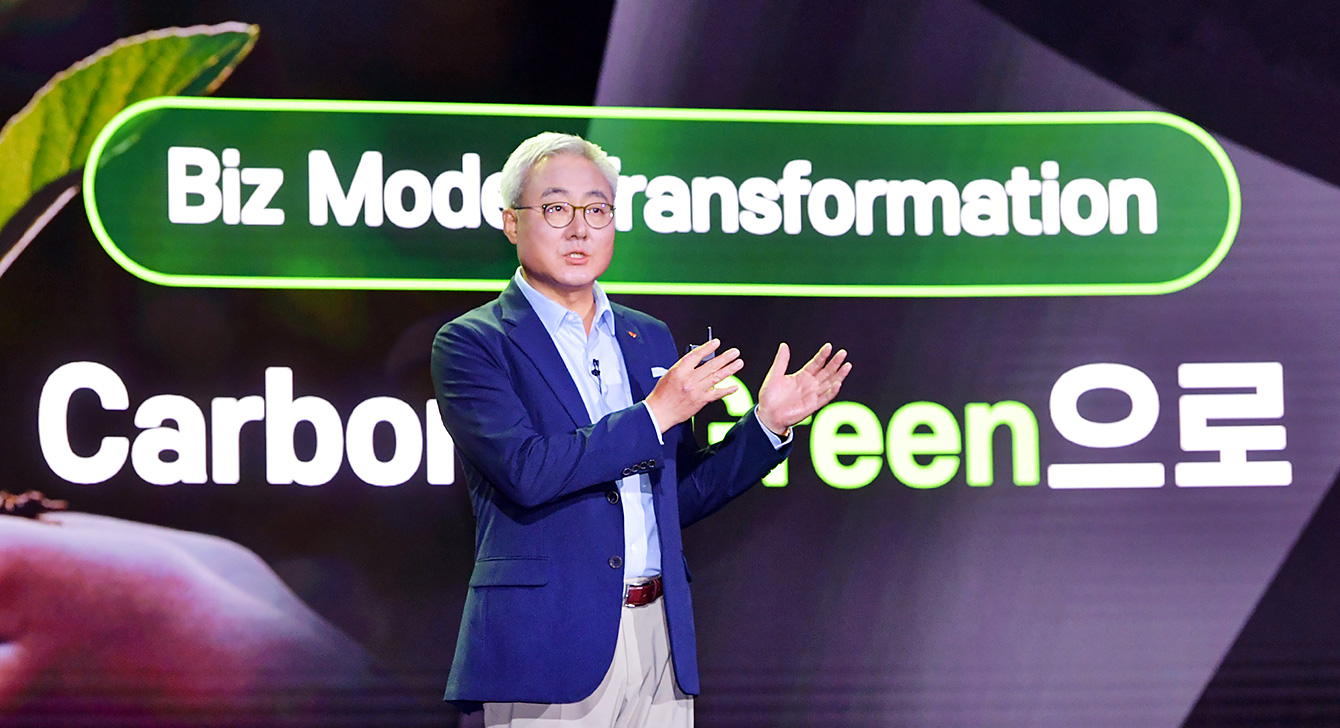

▲ Kim Jun, CEO & President of SK Innovation is presenting the company’s key strategy ‘Carbon to Green’ on Story Day event held last July

Among Korean petrochemical companies, SK Innovation was the first to announce a target to attain carbon neutrality by 2050 last July. Furthermore, the corporation offered major strategies that included, among other things, the reinforcement of an eco-friendly business model such as plastic recycling and a strengthened green portfolio centered on batteries, as well as participation in CCS projects. By 2025, SK Geo Centric, a chemical business subsidiary of SK Innovation, plans to buil an ‘urban oil field’ specializing in recycling plastic wastes in Ulsan Mipo National Industrial Complex.

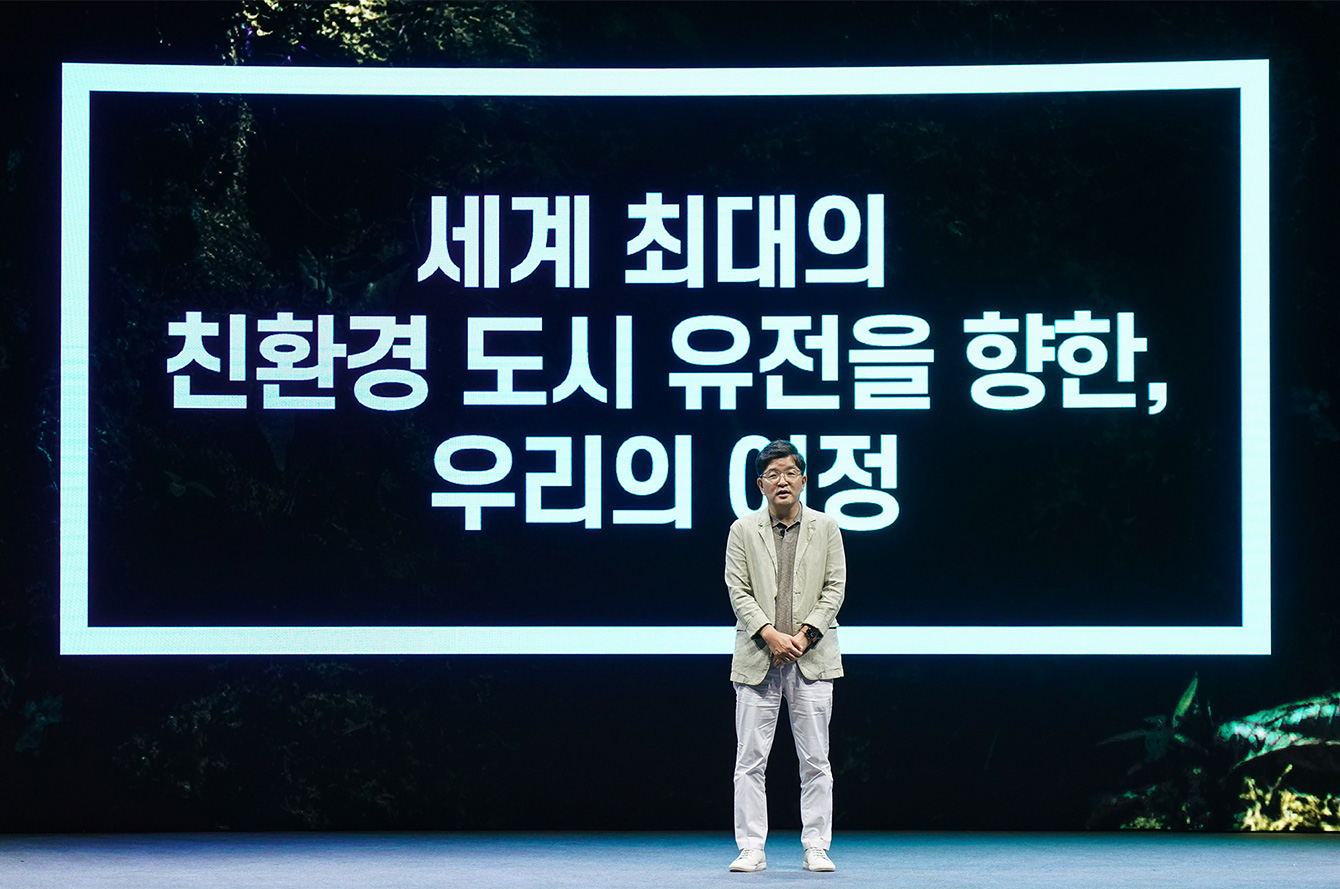

▲ Na Kyung-soo, CEO of SK Geo Centric, presents a concrete action plan of the company’s Financial Story at SKGC’s Brand New Day event in August 2021.

SK On, a battery business subsidiary of SK Innovation, has completed the value chain required for battery production and has strengthened its global status through collaborations with automakers. For the first time in South Korea, SK IE Technology, an information, electronics, and material business subsidiary of SK Innovation, succeeded in independently developing the lithium Ion battery separator (LiBS), a critical material for batteries.

SK Innovation’s oil exploration and production (E&P) business subsidiary, SK Earth On, and oil refinery subsidiary, SK Energy, on the other hand, seek to deploy carbon capture and storage technology to essential carbon dioxide emitting processes in SK Innovation’s Ulsan Complex. This project is linked to the Korea National Oil Corporation’s CCS project, which plans to store carbon dioxide in an East-sea gas reserve beginning in 2025.

▲ East-sea gas reservoir of the Korea National Oil Corporation

As demonstrated, major global companies and domestic (Korean) companies are all seeking to find a breakthrough in response to a carbon neutral era. Ironically, it seems that petrochemical industries appear to be crucial in the transition to a carbon-neutral future.

In other words, petrochemical corporations will take the lead in energy conversion by offering a reliable primary energy supply, oil, while also immediately entering the renewable energy business. The reason major petrochemical companies revamp their present business structures is that it is an inevitable choice so as to achieve their carbon reduction strategies.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin