Expert Voices

Expert Voices

What the heck is up with the electric vehicle industry??

If you have read the North American media recently you would get the picture that the EV industry is in decidedly poor shape and the future is very uncertain.

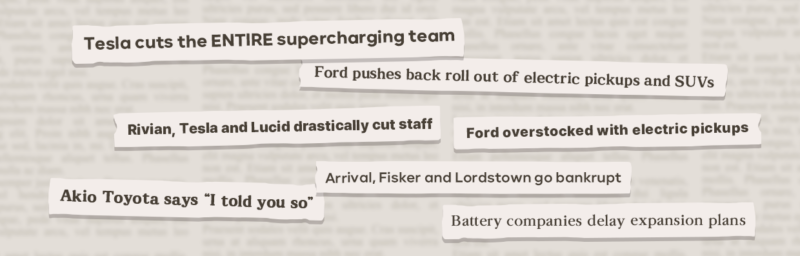

Here’s some recent news that we’ve seen in the last few months:

It’s unfortunately all true.

So, is this the end of electric vehicles (EVs)? What happened? What changed??

Let me be VERY clear: NOTHING has changed in the medium- and long-term outlook for EVs.

EVs will still be the dominant form of road transportation by the 2030s, and like every new technologically innovative industry that changes people’s behaviours, adoption has its pain points as the industry develops.

Therefore, it’s really important to understand the recent history and dig into why we are at this point with EVs today.

| EVs – A pathway forward

For decades people have been thinking about how to drastically reduce pollution in our transportation, a dream of zero emissions and drastically reducing our reliance on oil and gas.

EVs offered a pathway forward for zero emissions motoring that both completely nixed harmful tailpipe pollution, and drastically lowered carbon emissions over the vehicle’s life.

The “WHY” of EV was clear.

Back in the early 2010s the dream of the electric car came to fruition with the advent of the large lithium -ion battery, suitable for use in cars and trucks. The introduction of vehicles like the Nissan Leaf, and soon after the Tesla Model S, resulted in the volume production of EVs.

These were breakthrough vehicles, and as the decade progressed, they were soon followed by other great purpose built EVs like the BMW i3, Chevrolet Bolt and later the extremely popular Tesla Model 3. What’s more, public chargers began to be installed and EV long distance travel for the middle class became a reality.

| The COVID pandemic Supercharged EVs

Then something crazy happened, COVID hit. This once in a century pandemic knocked the world off its feet.

Governments pumped tons of money into the economy and EV purchasing and investing became the flavour of the month. Sales took off, share prices skyrocketed and the EV future looked like it had come! Between 2020 and 2023:

• Tesla became a trillion-dollar company

• Ford had hundreds of thousands of pre-orders for the F150 Lightning electric pickup

• EVs sold at dealers for $10,000 or more over list

• Governments mandated zero-emission vehicle (ZEV) sales mixes

• Chargers were rolled out at breakneck speed

• A tidal wave of new EV models was launched

• Model Y became the top selling passenger vehicle in the US, only behind F150 and GM trucks. In fact, it became the world’s best-selling vehicle in 2023.

An EV did this?? It sure did! Ten years ago, no one would have forecast that!

| The bubble bursts

Yet, the unfortunate harsh reality was that it became an economic bubble that burst, with the onset of inflation and then high interest rates. Suddenly, car payments became much more expensive, and the whole automotive industry slowed.

This resulted in wildly over valued EV share prices tanking, and some poorly thought out, newly formed EV SPACs (Special Purpose Acquisition Companies) began to look tenuous in their viability, and some went under. A look at the Tesla stock price over time gives a good indication of what happened. They are down by 50% on their all time high, but many multiples ahead of their 2018 valuation.

Yet, something crazy happened: EV sales DID NOT TANK! They kept climbing, although at a slower rate than previously. It was clear that the message of “WHY EV” had cemented itself in consumer minds.

However, OEMs, which had planned for extremely high levels of EV mix, based on 100% year on year sales increases, got caught out when EV sales ONLY expanded at 10% to 30% year on year. The result was oversupply, on expanding sales. In other words, a failure to forecast well was an industry wide problem with industry wide consequences.

Yet, let’s remember how far EVs have come. Ten years ago, EV sales were well under 1% of total US sales. Today they’re north of 7% of the national US sales mix, and over 25% in California. By 2035 it will be 100% in California, as well as in Canada and states that follow California’s regulations, which account for nearly 50% of North America’s new car sales (not including Mexico).

Globally, EV sales were up 30% to 3.4 million in Q1 2024 (the same as the annual volume number just 4 years ago), and some time in Q3 this year cumulative global EV sales to date will hit 50 million, with the IEA (The International Energy Agency) forecasting 16.4 million sales this year.

In other words, EV sales in North America are only on one trajectory – up. There’s no going back.

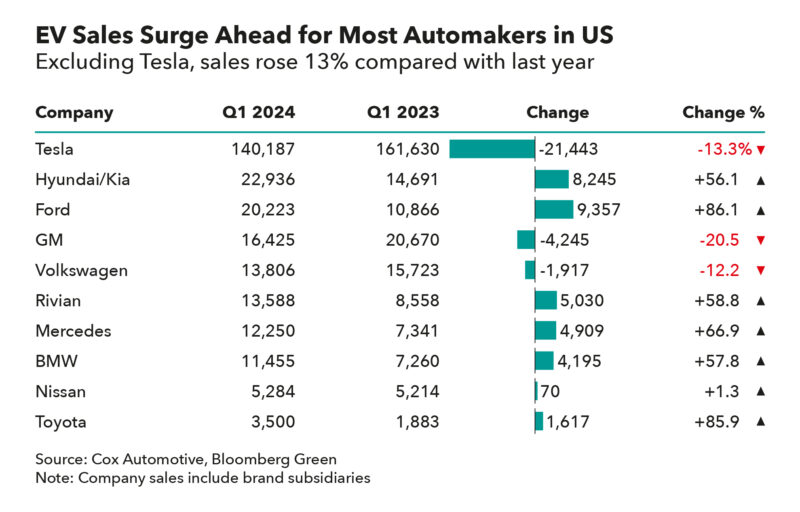

It’s worth taking a deep dive into the Q1 2024 US sales numbers to gain a deeper understanding of the current situation.

While the US EV registrations rose by 3.8% year on year, compared to the usual 30 to 50% growth we’ve been seeing, it’s well short of expectations. However, it is still (just) ahead of the 3.5% US automotive market increase over the same period.

The first place to look is Tesla. They are the “800-Pound EV Gorilla,” with over 60% US EV market share in 2023. Like Model 3, Model Y has been a runaway success due to its mix of performance space, new technology and access to the ubiquitous Tesla Supercharging network. Because of this large market share, any Tesla success or failure quickly superimposes itself on the broader EV market.

Despite Tesla’s success, sales for Q1 2024 have dropped by 13% versus Q1 2023, a very rare event for the brand. There’s a couple of reasons for this. The first is that their key vehicle, Model Y, is starting to age. It’s been on sale for over 4 years with virtually no hardware changes, and its popularity is beginning to wane as newer competitors go on sale.

The second is the production ramp up of the refreshed Model 3 “Highland” is taking longer than expected. Even though it’s a brand-new update of a very popular vehicle, sales have been off nearly 50%.

In total, with Tesla off by 13%, their share was down to just over 50% of the EV market, and it thus held down the entire segment.

However, for most EVs without a Tesla badge, the story was very different. After Tesla, the top two OEMs for EVs are Hyundai/Kia and Ford (both of whom use SK On batteries) who had sales well up on Q1 2023, with increases of 56% and 86% respectively. These are numbers much more typical of the growth we’ve previously seen with OEMs, and it is repeated with Rivian, Mercedes, BMW and Toyota.

The major reason for this growth is a ramp up of incentives, and a focus on leasing. For OEMs that do not make EVs in the US (or Canada or Mexico), they do not qualify for the USD 7,500 federal incentive, except if the vehicle is leased. By applying the government incentive, adding a factory incentive and a customer down payment, incredibly attractive monthly payments have been offered for consumers, from as low as USD 240 per month. These sorts of offers have made EVs available for LESS than an equivalent IC vehicle, and with huge energy savings to be had on top, that’s a very tempting offer many retail customers are taking advantage of.

| What’s next for EVs? Only UP!

Looking into the short-term future, things will only get better, and there’s several reasons for that.

The first is that the “800-Pound EV Gorilla,” Tesla, will be back with Model 3 Highland production issues sorted, and a major update of the Model Y due in early 2025. Simply put, they won’t be resting on their laurels, and significant sales volume will return.

The second is new models from many different brands with more affordable prices launching soon. A plethora of a high-volume models with low starting prices are now dropping, including the Chevrolet Equinox, Volvo EX30 and soon the Kia EV3. This will only expand in 2025 and 2026. While we won’t see Chinese brands entering the US or Canadian market any time soon, they are selling in a big way in Mexico. Make no mistake, the impact of the Chinese OEMs will force OEMs selling in US and Canada to significantly reduce prices, speed up engineering development and offer more compelling product, even if the urgency is somewhat buffered by tariffs.

The third is the localization of production for key EV models. By building in the North American Free Trade Agreement (NAFTA) countries, the USD 7,500 US federal credit is applicable on cash purchase and finance sales, as well as leased vehicles, thereby opening up the incentive to everyone. The first to localize was the Volkswagen ID4, and this is now being followed by the Hyundai IONIQ 5 and Kia EV9, which will result in a significant volume increase. Most other OEMs are following with local EV production over the next 3 to 4 years, including Honda, Toyota, Volvo, Mercedes, BMW and others.

| Are hybrids the answer?

Another piece to this story is the growth in hybrid sales, which in pure volumes terms, is similar to that of EVs. Many have pointed to this as a reason that EV sales are flat and that IC vehicles have a long-term future. What we’ve seen from the customer research done here at Vision Mobility is that hybrid buyers are ones that are struggling to make the jump from IC to EV, but still want to take a step towards a cleaner, more efficient vehicle. Buyers aren’t going from EV to hybrid, in fact it’s quite the opposite.

Hybrids introduce drivers to electrons, and electrons are addictive, with the only way that they can be fully satiated is to go full EV. If one looks at previous vehicles for EV owners, there’s almost always a hybrid in there, yet once in an EV, they don’t go back as EV retention is generally north of 80%.

Moreover, plug in hybrids offer buyers the same experience of charging as EVs, thereby increasing the comfort level further.

These thoughts are closely reflected in current US policy direction and by forward looking incumbent OEMs. Jennifer Granholm, the US Secretary for Energy, said hybrids “are the step that will lead to (electrification). We are bullish on that.”

Moreover, Korean OEM Kia Motors recently said that “hybrids aren’t a threat to EVs but are the perfect gateway to electrification.”

While hybrids offer buyers a “transitional comfort”, once the smoothness and performance of an EV drive is experienced and the realization occurs that it will suit their lifestyle just fine, there’s no going back.

The point is this: hybrid owners of today are the EV owners of tomorrow.

| All new technology has bumps in the road to success, EVs included

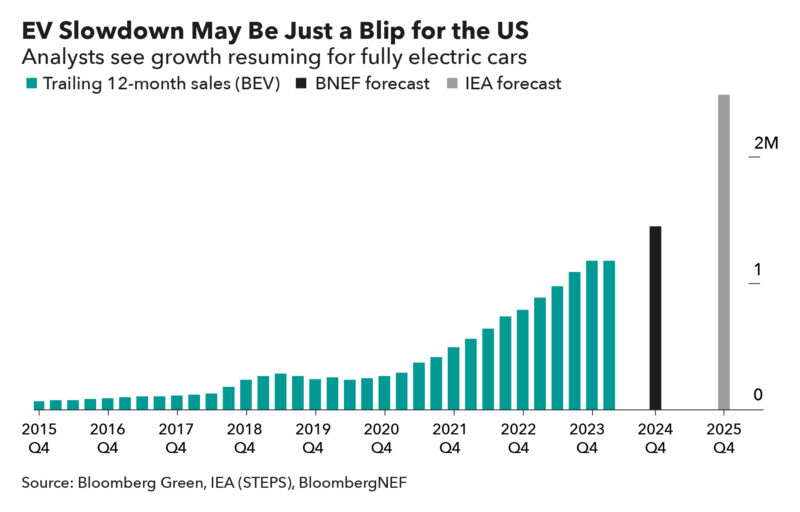

What this all adds up to is sustained medium- and long-term growth for EVs, and this is exactly the forecast from both BNEF (Bloomberg New Energy Finance) and IEA.

On the other side of the COVID bubble, the WHY of EV hasn’t changed. The dream of clean air, lower transportation emissions and less reliance on oil and gas is not just still there; we are now FAR closer to that dream.

Just like the dot com bubble 20 years ago, the EV bubble will have end results that are no different. The weak players are shaken out, but the strong players will not just survive, they’ll flourish. No one today can imagine going back to a world without the internet, and the same will happen with EVs in 20 years from now. Fundamentally, EVs are a far superior technology to internal combustion (IC) cars, and once the dust settles, EV growth will normalise until there are no IC models left on the market.

In other words, the learning is nothing has changed, except that on the road to an EV reality, the dream came with a few bumps, just like almost every other major technological shift in the last 200 years.

– SK On develops polymer electrolytes for lithium metal batteries

– Soon EVs will be the only vehicles purchased by lower mainstream buyers (by James Carter)

– Take the power with you: Why V2L is the must-have feature for new EVs (by James Carter)

– A passport ensures ethical transparency and sustainability to the battery minerals supply chain (by James Carter)

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin