Expert Voices

Expert Voices

“Purchase cost is no longer a major concern for EV buyers in the US”

A few weeks ago, one of my neighbourhood friends here in Toronto was asking for my thoughts on buying a hybrid SUV to replace their decade old minivan.

My immediate response was to suggest considering an EV, though I had assumed it would be significantly more expensive. Wanting to double check, I jumped on the OEM’s websites and compared lease payments. What I found surprised me.

The vehicle they were looking at was a Toyota RAV4 hybrid in mid grade XLE trim, so I chose the Tesla Model Y RWD to do price a comparison. After some adjustments to account for down payment, incentives and lease term length, I was shocked to find that the RAV4 was less than CA$50 per month cheaper than the Tesla. In British Columbia and Quebec, which add local provincial EV incentives, the Tesla was over CA$50 a month cheaper!

Yet the Tesla has more room, more standard features and technology, much better performance, a higher safety rating, and is much cheaper to run and maintain. The value is there, plus it is MUCH cheaper to run.

This comparison is important as these two SUVs are the #1 and #2 top selling (non-pickup) vehicles in North America, which means that many people are doing this calculation.

Some further research found that the business publication Forbes had come to the same conclusion. They found also most half of all EVs sold in the North American market are now cheaper to own than their ICE equivalents.

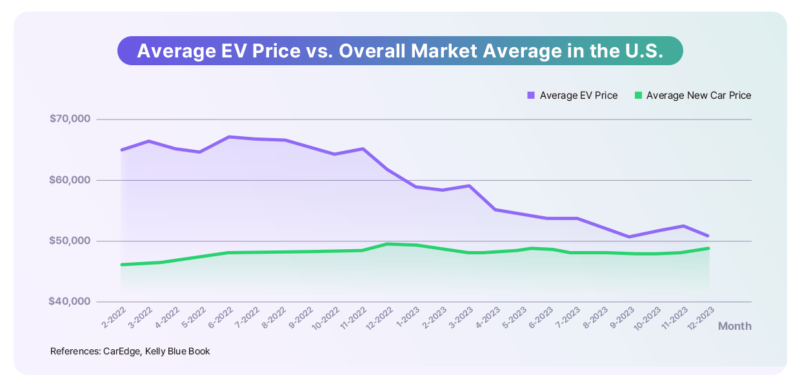

▲References: CarEdge, Kelly Blue Book

▲References: CarEdge, Kelly Blue Book

Moreover, JD Power’s recently completed study on EV cost of ownership over a 5-year time frame versus a traditional combustion vehicle had similar results. This study found that in 48 out of 50 US states it made more financial sense to buy an EV versus an equivalent ICE vehicle, sometimes to the tune of more than US$10,000.

That’s huge cash in most buyers’ language.

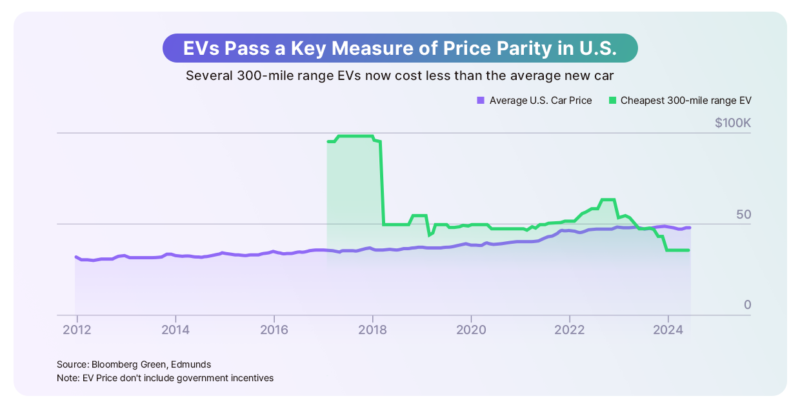

The first question to ask is how this can be the case. Weren’t EV supposed to be much more expensive?

The answer is that they were, but not now; and there’s five reasons why this is the case.

1) COVID driven inflation

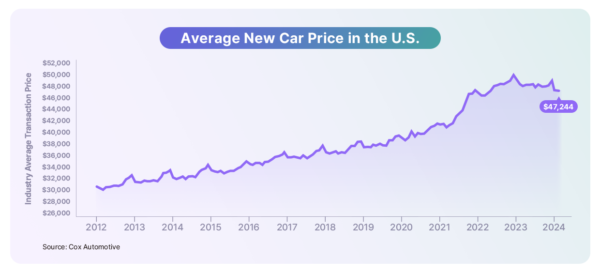

▲Source: Cox Automotive

▲Source: Cox Automotive

From the start of 2022 until mid 2023 the average price of a new vehicle rose from US$42,000 to US$50,000. In just 18 months a new vehicle had jumped almost 20%! Much of this was driven by supply chain shortages, which kept supply low, while demand increased due to government COVID recovery money being pushed into the economy. However, remarkably, as interest rates shot up to counter inflation, average new car prices have only seen minor decreases from this high.

Learning: Inflation and interest rates impact the entire automotive industry, EV and ICE alike.

However, as ICE vehicle prices increased across the board, EV prices fell, and there are several reasons for this:

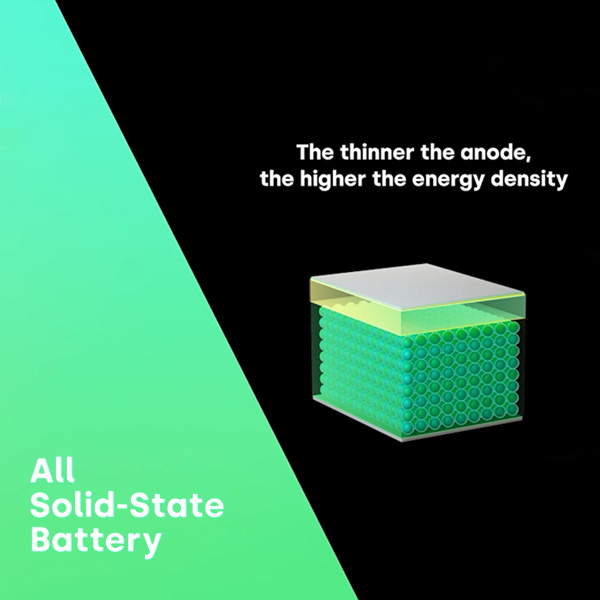

2) Battery and EV component prices continue to fall

In an electric vehicle the battery makes up as much as 20% of the entire vehicle’s build cost. Therefore, cost reductions here can significantly lower total vehicle cost. This is exactly what has been happening as lower commodity prices and newer cost reduction technology, such as LFP cells, are significantly lowering the cost of batteries.

Learning: Falling battery prices are creating the opportunity for lower EV prices

3) Changes to government rebates in the U.S. (Inflation Reduction Act)

In the United States, the US$7,500 incentive to purchase an EV has moved from a tax rebate to an upfront incentive, but at the same time, new restrictions have been placed on which vehicles that incentive applies to.

Essentially, a vehicle must be built in a USMCA free trade country, with batteries and their minerals sourced from countries with a Free Trade Agreement. However, as of today there is an exception: vehicles sold to companies still qualify for the rebate. This allows leasing companies to purchase EVs and apply the US$7,500 rebate for customers as a lease credit, drastically reducing monthly payments. It is now common to see EV lease deals for far less than an ICE vehicle, particularly in states that add further incentives.

Learning: Bargain EV lease deals in the US have as much to do with the government EV incentive structure as OEMs incentives.

4) Demand, Supply, Incentives, and Margins

Over COVID, there was nothing hotter in automotive than EVs. Demand was FAR higher than supply and OEMs had difficulty catching up due to the production expansion needed and COVID supply chain issues. Eventually, production (supply) caught up, right around the same time sales growth (demand) softened due to higher interest rates, creating a more balance inventory situation. On some models, OEMs even had over supply on growing sales, which was rebalanced with additional incentives.

With balanced supply, EVs began to behave like any other vehicle. Sales volumes (demand) are impacted by the competitive product offering, retail offers and overall economic factors; as well as OEMs ability to produce those vehicles (supply). OEMs that have decided to pursue aggressive sales plans, or have a need to clear excess inventory, have added extra incentives, just like they do with ICE and hybrid vehicles.

As an example, Stellantis recently announced emergency measures (i.e. HUGE incentives) to clear excess stock of their ICE RAM trucks and JEEP SUVs in North America, which occurred due to lower-than-expected demand. In other words, OEM demand / supply issues, and the levers they can pull to correct problems, are a normal part of the automotive business, regardless of the drivetrain.

Interestingly, comparing manufacturer’s suggested retail price (MSRP) points and incentives on similar vehicles between Canada and the United States, after currency adjustment, is very revealing. Canada’s MSRP points for EVs are often 15% to 20% LOWER than in the US for the same vehicle (reference: Hyundai IONIQ 5). However, as interest rates climbed, OEM distributors in the US have ramped up retail discounts to significant levels, while Canada’s incentives have been minimal, suggesting that both are using their margins in different ways to suit the market. In other words, the US retail discounts are funded by a fat MSRP margin buffer that doesn’t exist in Canada.

Learning: EV incentives aren’t an “EV chasm,” they’re a normal part of any OEM’s tactical business plan for any vehicle, regardless of whether they are EV or ICE, and in the US these EV incentives are being funded out of fat profit margins.

5) Local manufacturing

To take advantage of the changes in the US Inflation Reduction Act, OEMs have been localizing production of EVs. Full compliance allows for the US$7,500 rebate to also be applied to cash and finance purchases, not available otherwise. One of the biggest has been the new and massive US$7.6 billion Hyundai production facility in Georgia, USA that produces the IONIQ 5 and the Kia EV9. With a capacity of 300,000 units annually, this factory will create 8,500 direct jobs, as well as another 3,500 jobs at the nearby SK On joint venture EV battery cell plant.

Other EVs from non-North American brands with recent new start of production in North America include the Volvo EX90 and Polestar 3, made in Charleston, South Carolina; Volkswagen ID4, made in Chattanooga, Tennessee; and Honda Prologue and Acura ZDX, made in the Ramos Arizpe plant in Mexico.

The combination of these things has resulted in several EVs with over 300 miles of range being available for purchase for UNDER the US average new car price, a key range figure that opens acceptability for most North Americans.

All these factors are adding up to EV sales that are continuing to grow faster than the market. Though down from their record growth rates in 2022 and 2023, Q2 2024 saw EV sales grow at 8% over Q2 2023, compared to 3% for the entire market, according to the data shown in “Q2 2024 Kelly Blue Book EV Sales Report.”

However, one problem does remain, and that is the lack of affordable EVs under US$35,000. While EVs on sale compare very well with their ICE competitors, the lack of vehicles for the value buyer is an issue. This is quite different to markets like Europe and China that offer an assortment of lower cost electric vehicles. This appears to be changing as new models are on the horizon to fill this gap, including the Kia EV3, updated Chevrolet Bolt and a low-cost Ford model.

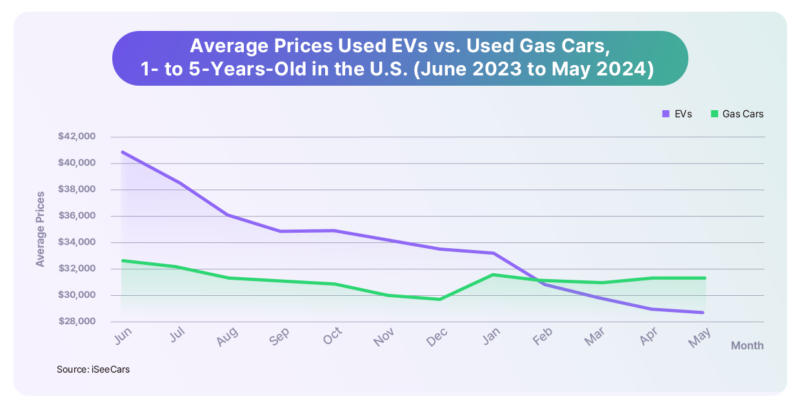

The stabilizing of prices and supply has resulted in another benefit: a proliferating used EV market. This is important as in North America, four used cars are sold for every one new car. With EVs becoming popular new cars, the number of used electric vehicles available has quickly grown. This newfound supply, plus the new EV tax credit in the US, has allowed lower budget buyers to step into an EV and exploit the operational cost savings at a price that they can afford.

▲Source: iSeeCars

▲Source: iSeeCars

But, is it true that the purchase cost for buyers has become no longer a top concern? According to the most recent Annual Global Mobility Study that Vision Mobility, CuriosityCX and LEK Consulting prepare annually across nine countries and over 3,000 respondents, battery life has replaced purchase cost in the US as the #1 concern for EVs. In fact, purchase cost is no longer even in the top 3 EV concerns!

Yet, while the cost of an EV battery replacement can be expensive, the warranties and technical design means that few new car buyers need to worry. Most EVs sold today have a warranty of at least 8 years or 120,000 miles (192,000 kilometres) and are designed for 1,500 to 4,000 cycle rating (full to empty = 1 cycle) or 600,000 to 2 million kilometres of use, the concern seems more fuelled by other factors such as unbalanced media reports and previous experience with cell phones than actual data.

The future widespread adoption of EVs in North America has as much to do with continually removing barriers and objections as anything else. Once purchase price was a very significant issue, now that has been removed. Now concerns over battery longevity have become an issue, yet with long warranties and improved technologies, this will also pass by the wayside. Fire risk has been a concern among some, but the actual data shows the rates of EV fires are miniscule when compared to IC vehicles.

Will other concerns pop up for EVs over the next few years? Almost definitely, and those too will be worked through. There’s absolutely no doubt that EVs will become the dominant form of transportation over the next 20 years because they are far less polluting, technically superior and now, lower cost.

While the industry’s fortunes will go up and down, over the long term, EV dominance of the automotive industry is something you can bank on.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin