Expert Voices

Expert Voices

ㅣBattery business expansion strategy based on regions

While Europe and China have pushed the EV market forward, the proportion of EV sales in total automotive sales in the United States was just 10.4 % in the third quarter of 2021. However, as the Biden administration seeks to introduce relevant legislation, such as an increase in EV subsidies, US automakers, and battery manufacturers are aligning with the government to convert to electric vehicles. Furthermore, EV demand in the United States is soaring, with EV sales increasing by roughly 60% year-over-year in the third quarter of 2021.

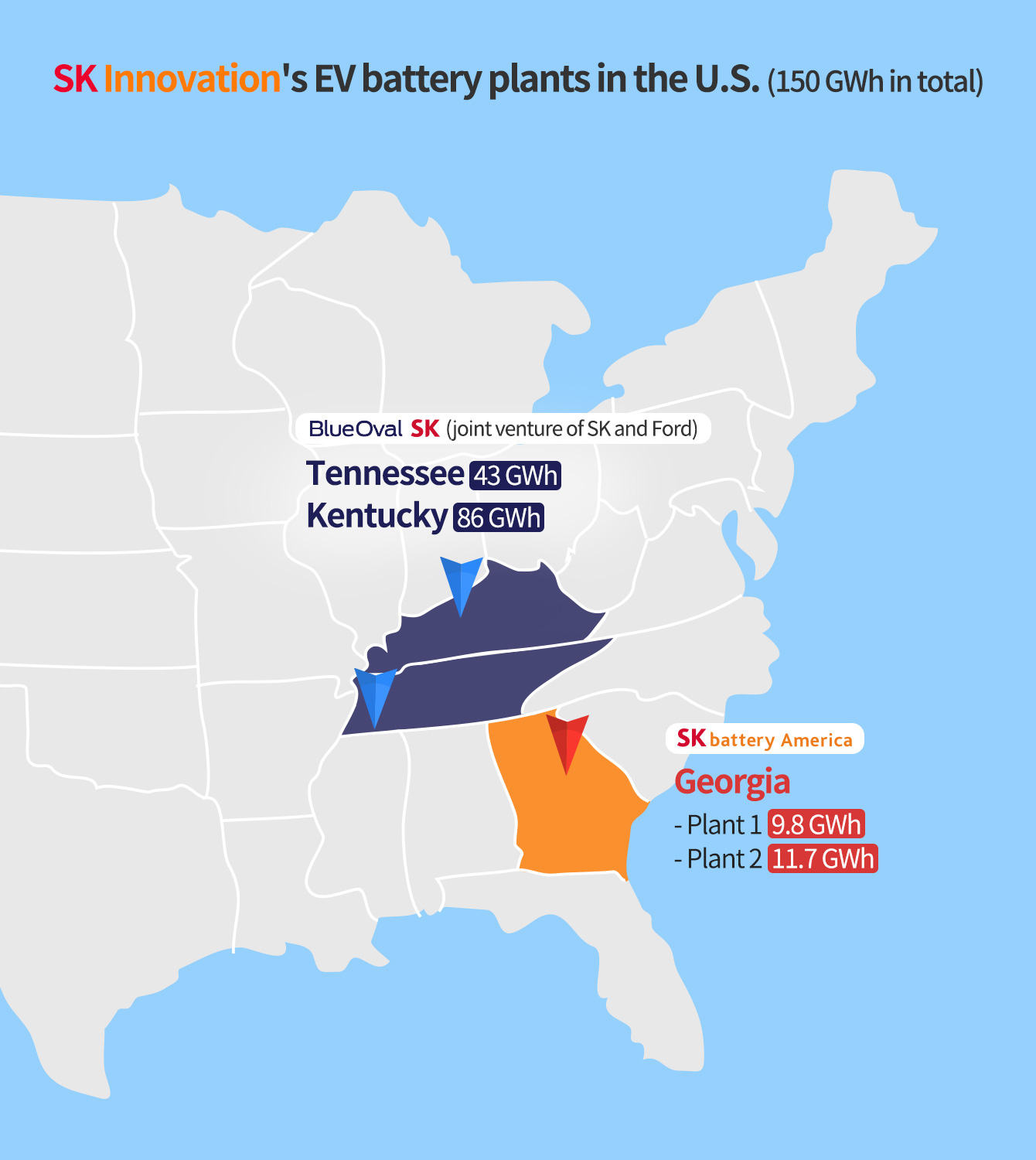

It is necessary to abide by Regional Value Content (RVC) in order to receive preferential tariff treatment under the country-of-origin regulation in United States-Mexico-Canada Agreement (USMCA), and it is unavoidable to use batteries made in the United States to respond to the US EV market. SK On, a battery business subsidiary of SK Innovation, was the first to react immediately to the US market and subsequently has solidified its position as one of the world’s top three battery cell manufacturers based on order backlog thanks to its collaboration with US OEMs. Besides, SK On’s penetration into the Chinese market through joint ventures is worth noting as the company’s regional battery business expansion strategy.

▲ SK Innovation’s EV battery plants in the U.S.

ㅣSecuring upstream materials and battery recycling technologies

The prices of lithium and nickel, two key minerals for batteries, have risen by 240% and 20%, respectively, in the last 11 months. Raw material selling prices and supply are unpredictable since they are influenced not only by supply and demand but also by regional and political factors.

On the other hand, it’s worth noting the countermeasures taken by related enterprises. Battery cell manufacturers are busily preparing for alternatives such as securing a long-term direct supply contract and investing in mining and smelting operations. Tesla, for example, bought the New Caledonian nickel/cobalt business from Vale, a Brazilian mining corporation, in March and stated in July that it sought to partner with the Indonesian government to invest in a nickel factory in Indonesia, which has the world’s largest nickel reserves. Also, in October of this year, CATL acquired Millennial Lithium, a Canadian mining company, in order to excavate lithium directly in Argentina’s Salta Province. In the instance of SK On, the business signed a supply arrangement with Glencore, the world’s largest Switzerland-based cobalt producer, in 2019 to assure a supply of around 30,000 tonnes of cobalt by 2025.

Moreover, battery cell manufacturers are pursuing to enter into a battery recycling industry. According to SNE Research, the battery recycling market is predicted to surge from USD 1.5 billion (about KRW 1.77 trillion) to USD 18.1 billion (about KRW 21.38 trillion) by 2025. Recycling discarded batteries is critical from both an economic and environmental standpoint, and SK Innovation’s foray into the recycling business is favorable as it is a market-leading move.

SK Innovation announced the successful development of a lithium hydroxide recovery technology at the Story Day event on July 1, 2021. It is expected that the company will continue to update concrete action plans, such as the scale of mass manufacturing and how to secure used batteries, in order to keep in touch with the market.

ㅣSpecific stragies for each segment

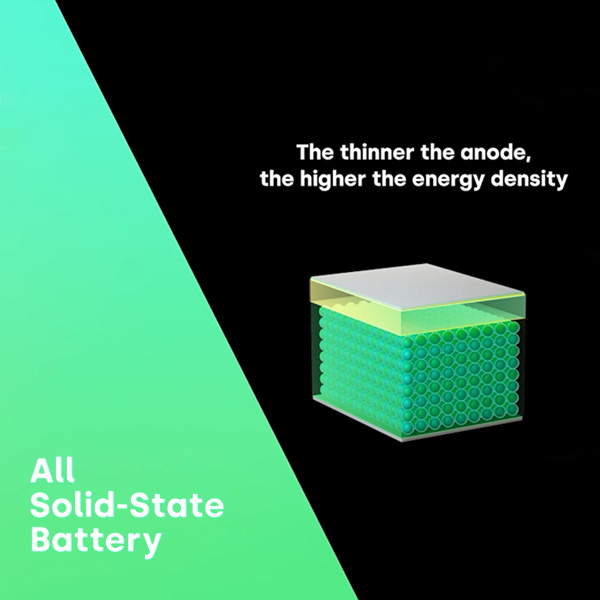

So far, SK On has been at the forefront of high-nickel battery technology. NCM 811* batteries were mass-produced for the first time in the world in 2018, and NCM NCM9 ½ ½** batteries will be available in 2022. However, the market share of low cost Chinese LFP (Lithium Iron Phosphate) batteries is increasing, posing a challenge to Korean battery makers. Aside from the domestic demand in China, Tesla’s announcement that it will use LFP batteries in its vehicles was a setback for Korean battery makers.

▲ The Next Battery introduced by SK Innovation at “Interbattery 2021” held in June this year

(*) NCM 811: a type of battery that has nickel-cobalt-manganese at a ratio of 8:1:1.

(**) NCM9 ½ ½: a type of battery that has nickel-cobalt-manganese at a ratio of 9:0.5:0.5.

While a premium-focused expansion plan is vital, SK On must also consider the mid-low price battery market, which is growing even faster, if the firm is to move forward from its current position. SK On is also working on research on mid-low price batteries and next-generation batteries. Experts believe that in the future, technologies such as cobalt-free and Mn-rich batteries will be able to rival LFP batteries.

The market anticipates SK On’s response to the mid-low price battery market, as well as the company’s more specific strategy and plans for next-generation batteries beyond 2025.

* The above article was translated from Korean and a minor part of it was changed by SKinno News admin to match the target readers of English SKinno News channel.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin