Expert Voices

Expert Voices

▲ Ferrari’s first PHEV SF90 Spider model (left) and Genesis GV60 model (right) loaded with SK On’s battery were displayed in SK On’s booth at InterBattery 2022 held from March 17 to 22 in Seoul, Korea.

Last year, numerous media outlets plastered their headlines with IT giant company Apple making autonomous vehicles. And that started to confuse me as to which industry I should classify the EVs. Recently, several Japanese electronic home appliance companies, such as Sony, expressed their intention to release EVs. But when you think about it, there is nothing strange here. It is so because, in the case of vehicles with cutting-edge safety devices, 35% of their components are made of electronic parts, and as for the EVs themselves, the price of the battery takes up to 30 ~ 40% of the total cost. The experts expect that the percentage will go up over 70% in no time. So EVs can be considered electronic products, and rightfully so. Also, from the investment perspective as well, in comparison with the traditional car companies, the companies that vow to produce only EVs see their investment values soaring beyond anyone’s imagination.

First off, Tesla’s market capitalization is USD 852 billion. As for Toyota, it is USD 216 billion, while Volkswagen’s market capitalization is USD 91.9 billion, and Ford’s is USD 64.2 billion. To put things into perspective, Tesla sells about 500,000 EVs every year, while Toyota makes 10 million sales annually across the globe, which is 20 times more than Tesla. However, Tesla’s market capitalization is four times larger than that of Toyota.

Rivian Automotive was established in 2009, and its competitiveness lies in shifting the pickups into EV trucks. It signed a supply contract with Amazon to provide 100,000 EV vans. The completion of delivery, however, is expected to be by 2030, and this entails how it is behind in terms of its production capacity. That means that it can currently only produce 1.5 trucks a day on average. Despite that, on the very first day the company got listed on the stock market, its price soared by 29% and doubled six days laters. Consequently, the company became the third largest by capital market after Tesla and Toyota. But of course, there were some investors with concerns about its production capacity and marketable quality, which led the stock price to the 15% dive in a day, dragging it to become the 5th company in terms of the market cap. The issue here is that Rivian’s market cap prides itself on USD 129 billion when it is currently requiring constant investments from the market without making significant sales. What this tells us is clear. The market highly valuates the future cars, that are, EVs.

Even Ford announced its plans to divide its business into EV and ICE vehicles. This American automotive giant wishes to receive a fair and objective assessment by the investors on the EV business after the separation.

Such changing environment in the car industry demands a change in the battery companies as well. Ever since SK On separated itself from SK Innovation, it has been pondering numerous ways to improve its corporate value aside from solely focusing on technology R&D.

Tesla drew a lot of attention from people primarily for its driving range. In the early days of the EV, one charging only allowed a driving range of 150km or less, which was suitable for commuting to work downtown. It was the most reasonable choice considering the battery price and efficiency. But that changed when Tesla embraced the minority’s opinion and announced its plans to produce cars with highly increased driving range. As a result, just by car sales contracts alone, it made enough money to build factories. I used to speak ill of Tesla for its technological capability and car quality. But come to think of it again, it is thanks to Tesla that it raised the industry standard on the driving range that most EVs now can go more than 400km on a single charge. In other words, Tesla’s dramatic change worked for the better.

And the battery companies should judge for themselves whether it is advantageous for them when their slice of the pie is getting larger in the market. This is primarily because the economy of scale could supersede technological competitiveness. The aspects that should be equally considered along with insourcing the battery is the issues of safety and decreased performance in low temperature.

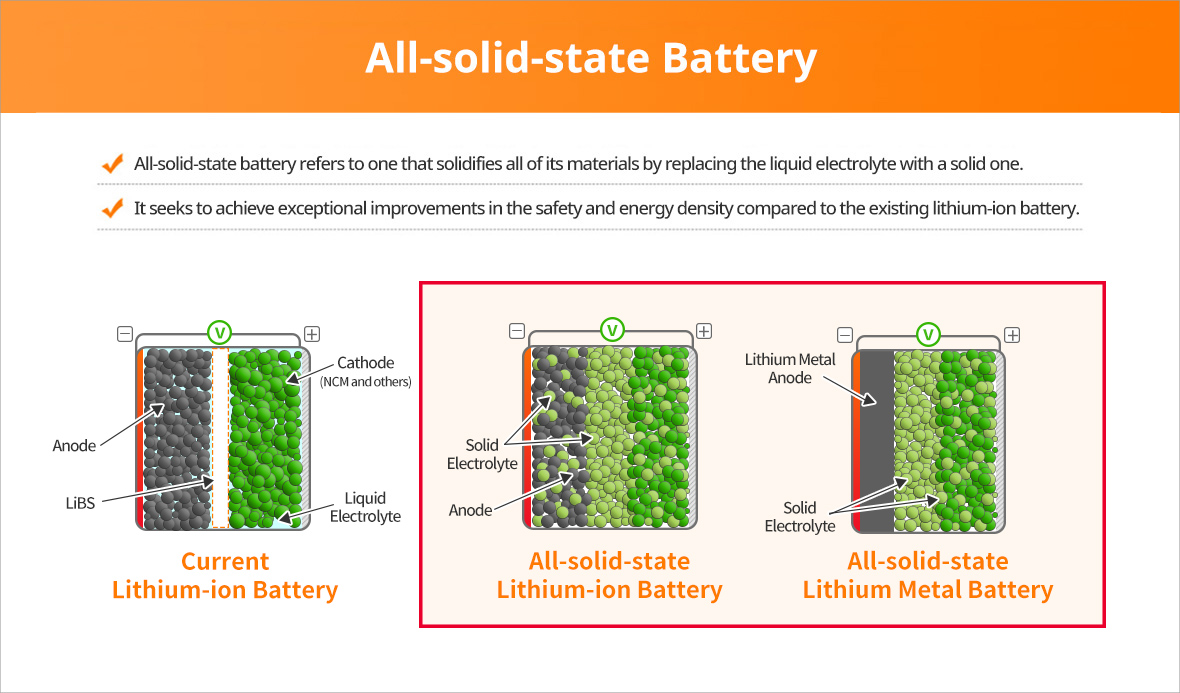

In the case of the lithium-ion battery being used today, it is heavy and takes long to charge. The heavy weight of the battery also acts as a factor in deteriorating ride quality. The new technology that is expected to solve all these downsides is the all-solid-state battery. Since the existing lithium-ion battery is based on the liquid electrolyte, it has the risk of electrolyte* leakage and is limited in changing its form in any shape. Moreover, the battery’s working temperature range is narrow because of the condensation or vaporization of the liquid electrolyte.

* Electrolyte: When electrolysis is conducted by using a separator, the electrolyte works as a medium that allows lithium ions to move so that the electrochemical reaction of the positive and negative electrodes happens smoothly.

Compared to this, the all-solid-state battery ensures safety as it boasts a low risk of explosion and fire. Moreover, it can be easily assembled and still stably works when it is damaged or impaired. It is also free from the risk of leakage, and once the manufacturers create a composite solid electrolyte, which is combined with the separator, it can also reduce the size of the batteries. This means that the all-solid-state battery guarantees the same performance and driving range at half the weight and volume of the lithium-ion battery. In addition, the manufacturing process is also easy. However, at the current level of technology, there is a drawback. The ionic conductivity of the solid electrolyte falls short of that of the liquid one.

In a new industry, competitiveness is judged based on resources, technology, market, and regulation. South Korea lacks the resources, and its market size is also small due to its small population and land. For instance, the size of China’s domestic market is tantamount to South Korea exporting to 27 nations. So that leaves us with two things, technology, and regulation. In the past, products developed with excellent technology ensured easy export to other countries, but now, it is now more difficult because the companies need to test and verify the systems and platforms at the same time.

Therefore, drastic deregulation is required to test and verify new technologies in Korea. Japan, whose development of hydrogen vehicles took place a year later than South Korea, is now one step ahead of us in its technology, thanks to the Japanese government’s support and alleviation of various regulations. This current trend calls for the South Korean government to face reality. Moreover, Japan boasts that it will be able to mass-produce all-solid-state batteries by 2025 if everything goes well. And if the government, private companies, and public R&D institutes do not jump in to cooperate and narrow this technological gap right now, it seems that South Korea will likely be excluded from the countries that lead the future EV market.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin