Expert Voices

Expert Voices

▲ A Ford’s F-150 car thdisplayed at SK Innovation’s booth at InterBattery 2021

The first time I saw a large American pickup truck, I was shocked. Shocked at just how HUGE they are. It was around 2002, a then new Toyota Tundra, that Toyota Australia had brought in for evaluation. Four inches wider than a Land Cruiser and almost 3 feet longer, this thing was enormous. Later I found out that Americans considered it a ¾ quarter truck – it was not big enough, and hence did not sell that well. My mind was blown!

For me, growing up on a cattle farm in Australia, a pickup, or ‘ute’ as they call them, wasn’t much bigger than an average car. Indeed, the pickup I learned to drive on had a 2.0 litre, 4 cylinder engine, less than half the size of the typical American specimen.

Fast forward a few years, I moved to Canada and worked with the Toyota Product Planning team launching the then new Tundra. This one was ‘full size’ like the Detroit 3 trucks, had a 380hp V8 engine, and some models were 19ft in length, making parking a real challenge.

That truck drank like a sailor, commonly recording 15 litres/100km on the highway and 20 litres/100km around town in real world fuel consumption; similar to competitors, and an astounding three times more than what you would expect from an efficient compact car like a Hyundai Elantra. What is more, when towing the big boat or camper trailer, these numbers could easily double.

But all this is North American normality. Out of the big city downtown core, large pickups are everywhere. In a pre-Covid ’normal’ 17 million US annual market, pickups represent about 2.8 million unit sales in US, with Canada adding another 400,000 or so. This number is larger than the entire market volume of Korea (approx. 1.8 million), Canada (approx. 2 million) and UK (approx. 2 million). If North American pickups were a country, it would be the fourth largest market in the world.

Pickup sales have been dominated by 3 models for decades: The Ford F-150 (the perennial best seller), the General Motors twins GMC Sierra and Chevrolet Silverado, and the Dodge RAM. Toyota and Nissan have had strong product with the Tundra and Titan for years, yet they don’t sell nearly as well. Customer brand loyalty runs as thick as blood in this market.

Interestingly, pickups have become the de facto status symbol of the heartland wealthy. Where once it was a Cadillac, today it’s about a full loaded pickup truck and the toys that go with it. Sure, BMWs, Mercedes, Lexus and Tesla sell well on the coasts, but drive a couple of hundred miles inland, and its pickups that rule the road.

This has made pickups wildly profitable for their respective manufacturers. With top models approaching $80,000, and many owners spending thousands more on accessories, profit margins are fat. The Kelley Blue Book, which publishes average new vehicle sales prices in the US, found that year to date in 2021 the average pickup goes out the dealer door for over $56,000, almost $20,000 above the price of an average vehicle.

So, why has North America developed such a taste for large pickups? In short, access to cheap energy with relatively high incomes which has lasted for the best part of a century. Petrol in the United States is among the cheapest in the world, and typically half the price of many European countries, so people can easily afford to go big.

With such popularity of a high emission vehicle type comes a terrible cost – pollution. Of the approximately 250 million vehicles registered in the US, more than 50 million are pickups. With an average mileage of approximately 15mpg, covering 15,000 miles per year each, we can see these vehicles collectively drive 750 billion miles, consume 50 billion gallons (175 billion litres) of petrol, creating 426 million metric tonnes of CO2 annually. As well, millions of tons of deadly CO, NOx, SOx and particulates are also created, which contributes to bad air quality and millions of premature deaths every year.

All I can say is: “Houston, we have a problem.”

However, there’s a seismic shift that’s taking place in large pickups – battery electric. While there have been announcements from new players, it was Ford’s recent preview of the F-150 Lightning BEV, with batteries supplied by SK Innovation, that sent shockwaves through the industry. Launched by none other than Joe Biden, the President of the United States, his test drive quote “This sucker’s quick!” became THE talking point for days.

Cleverly, Ford designed the truck for Middle America. The styling is familiar, very similar to a regular gas F-150, and it added appealing features like a large front trunk (called the “Mega Power Frunk”) with standard V2L (Vehicle to Load) AC (Alternating Current) power outlets of 2.4kW capacity that can power a campsite, off grid work site or homes during an electricity blackout. Recently, the automaker even revealed that this number will be up to 9.6kW with the release of new models next year. You could power a small village with that, or roadside charge your friend’s EV if they didn’t take range anxiety seriously enough.

What’s more Ford chose to keep costs down by using as much of the gasoline F150 parts as they could. This meant that they can offer an entry price point under $40,000 before any incentives – lower that the average pickup purchase price. When subsidized with government incentives, MSRP points are competitive with the gasoline variants.

Initially, Ford announced that the F150 Lightning production would be around 40,000 units per year from the 2022 production line off. However, pre-orders quickly exceeded 100,000 in less than 2 weeks after unveiling. Clearly Ford had dramatically underestimated demand, and in early September, they announced it would double annual production to 80,000 units per year.

While Ford clearly stole the early EV pickup ground with the F-150 Lightning, you can bet competitors won’t take this lying down. Both General Motors and Stellantis have responded, with a promise to introduce a Silverado EV, a variant of the expensive GMC Hummer in 2023, and a RAM EV in 2024, respectively. Coupled with the Tesla Cybertruck, it’s not too much to expect that the BEV pickup sales could exceed 400,000 units annually by 2025.

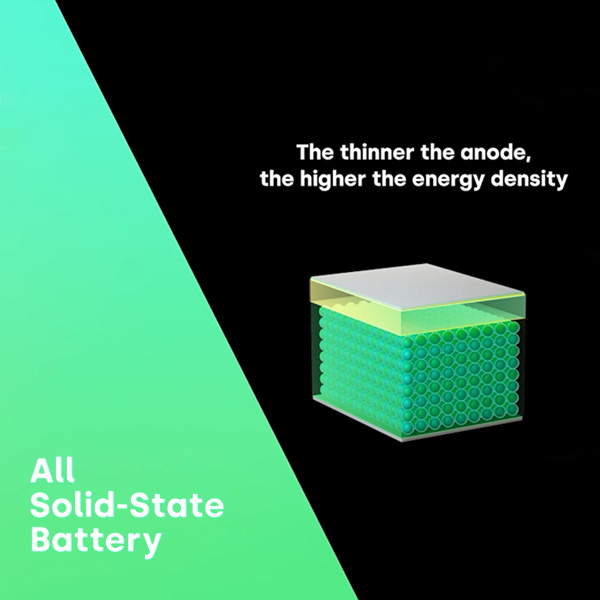

For battery suppliers like SK Innovation, the coming rapid growth of battery electric pickups in North America presents an unprecedented opportunity. When considering that the magic range number is around 300 miles required by American drivers, for energy hungry pickups, batteries sized between 100 kWh to 200 kWh will be needed. Multiplied by the potential volume of 2.8 million units over the next 15 years just in pickups, and you’ve got many terawatt hours of batteries flying out the door.

Of course, if you are a battery supplier partnering with the market leader in pickups, as SK Innovations is doing with Ford, then you’re really at the pointy end of dramatic future growth. Their recent multi-billion BlueOvalSK joint venture announcement to build large scale battery production facilities in North America is further proof of the future market opportunity that both are forecasting, and signals that many in the industry are poised to move quickly.

Clearly, even in conservative United States, electric vehicles hold a lot of appeal, and BEV pickups represent a huge opportunity to drastically lower emissions and improve air quality. When coupled with US government mandates, tightening vehicle emission regulations and consumer interest in electric pickups, the direction of the industry is very clear. This is fantastic news, for not only the automakers and battery manufactures, but also for our planet and our children.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin