2024.09.24

Series

Series

01 | ExxonMobil, trapped in “oil addiction” versus BP, announced strategy for zero carbon commitment

On October 28th (local time), the Financial Times published an article titled “Why ExxonMobil is sticking with oil as rivals look to a greener future.” The article quoted Amy Myers Jaffe, professor at The Fletcher School at Tufts University as saying, “Exxon was a superpower in every sense of the word”, “but no more does it have this status.“ It continued by mentioning analysts’ views that “a quest for fast oil-production growth and an addiction to risky, high-cost projects have hobbled the company in recent years.” The article concludes with an emphasis that “the lingering perception of some in the market is that the company’s devotion to oil is a source of Exxon’s current failings.”

On the other hand, BP’s transformation seems to be receiving positive responses from the market. In February this year, BP Chief Executive Bernard Looney pledged that “BP will reduce its emissions to net zero by 2050 or sooner.” Following this announcement, in August, the company revealed a detailed “strategy for decade of delivery towards net zero ambition”, which includes cutting oil and gas production by 40% by 2030. According to this strategy, BP aims to expand investment in low carbon energy over a decade by 10 times compared to the current level, and increase renewable generating capacity from 2.5GW in 2019 to around 50GW in 2030.

On the day this strategy was announced, BP’s stock price soared by 6.8%, and the global consulting group Wood Mackenzie also evaluated that BP’s strategy was the clearest and most specific among the plans of major oil companies.

02 | ESG management cannot be attained in a day

The press and industry commented that the cases of two major oil companies ExxonMobil and BP are proof that companies should make a paradigm shift towards ESG management.

Being the first and largest energy-chemical company in Korea, SK Innovation is fully aware of the importance of ESG in its performance and has been making efforts to execute ESG management. SK Innovation is re-examining its business portfolio through eco-friendly products such as eco-friendly lubricants, asphalt, ultra-light car materials, and high value-added packaging. In addition, the company is also proactively responding to environmental regulations. Operating various programs to support and collaborate with eco-friendly social enterprises and ventures is also a part of SK Innovation’s ESG management.

As a result of its efforts, SK Innovation has received all A grades in the ESG evaluation conducted by Korea Corporate Governance Service this year. In particular, SK Innovation ranked first among 740 domestic listed companies in the social sector (S). The company has been receiving positive recognition for its ESG management from not only domestic but also foreign stakeholders. It was proved by the recent result of DJSI (Dow Jones Sustainability Indices) evaluation this year, in which SK Innovation has been selected as a “DJSI World Company” for four consecutive years.

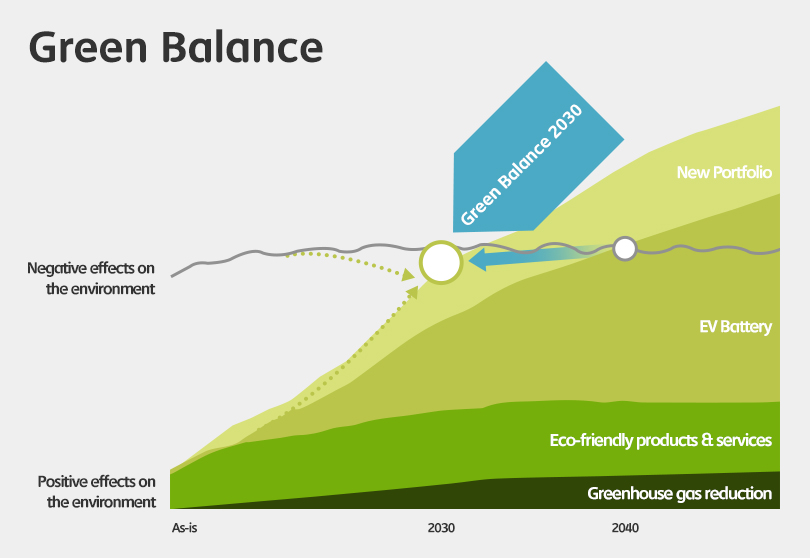

The driving force behind SK Innovation’s ESG management practice is the “Green Balance 2030” strategy, which aims to innovate the company’s business structure so that the positive environmental impacts offset the negative impacts by 2030. The strategy shows SK Innovation’s determination to go beyond the wave of change by anticipating, preparing and implementing the paradigm shift to ESG management.

03 | Green Balance 2030, the essential of ESG management for SK Innovation’s sustainable growth and development?

In 2019, SK Innovation declared “Green Balance 2030” as a goal, as well as a practical tool for ESG management. To achieve this goal, the company is actively promoting Portfolio Transformation in accordance with three strategic directions: Green, Technology, and Global. First of all, SK Innovation is planning to leap to become a global top player with differentiated technology by investing boldly in the electric vehicle battery and material business, which are not only growing but also green business. This allows the company to expand the proportion of the green portfolio.

Especially, by actively utilizing the battery business capabilities accumulated so far, SK Innovation is looking for a new growth opportunity with BaaS (Battery-as-a-Service) as a strategic platform with 5R (Rental, Recharge, Repair, Reuse, Recycle) strategy that can complete the value chain of the battery business beyond the production of electric vehicle batteries. In addition, SK Innovation has joined the Global Battery Alliance (GBA) and the Responsible Minerals Initiative (RMI) to take the lead in creating a sustainable global battery ecosystem.

Furthermore, the company is pushing forward business-oriented 3R (Reduce, Replace, Recycle) activities to solve the waste plastic problem, which is a global issue, and is building a foundation for stakeholders in the value chain such as the “Korea Eco-Friendly Packaging Forum” to participate and collaborate together.

Technology is also an indispensable element to give wings to Green Balance 2030. Using innovative digital technologies, the company is transforming its business into a market-and customer-centric one, and accelerating business model innovation through digital transformation.

Last but not least, SK Innovation is actively promoting global partnership to accelerate its global performance in the battery and materials business through strategic cooperation with various partners, while enhancing the sustainability of the petroleum, chemical, and lubricant businesses. Through these activities, SK Innovation has the ambition to complete ESG management by achieving Green Balance 2030 that innovates the happiness of all stakeholders, including all members, customers, business partners, shareholders and society.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin