Expert Voices

Expert Voices

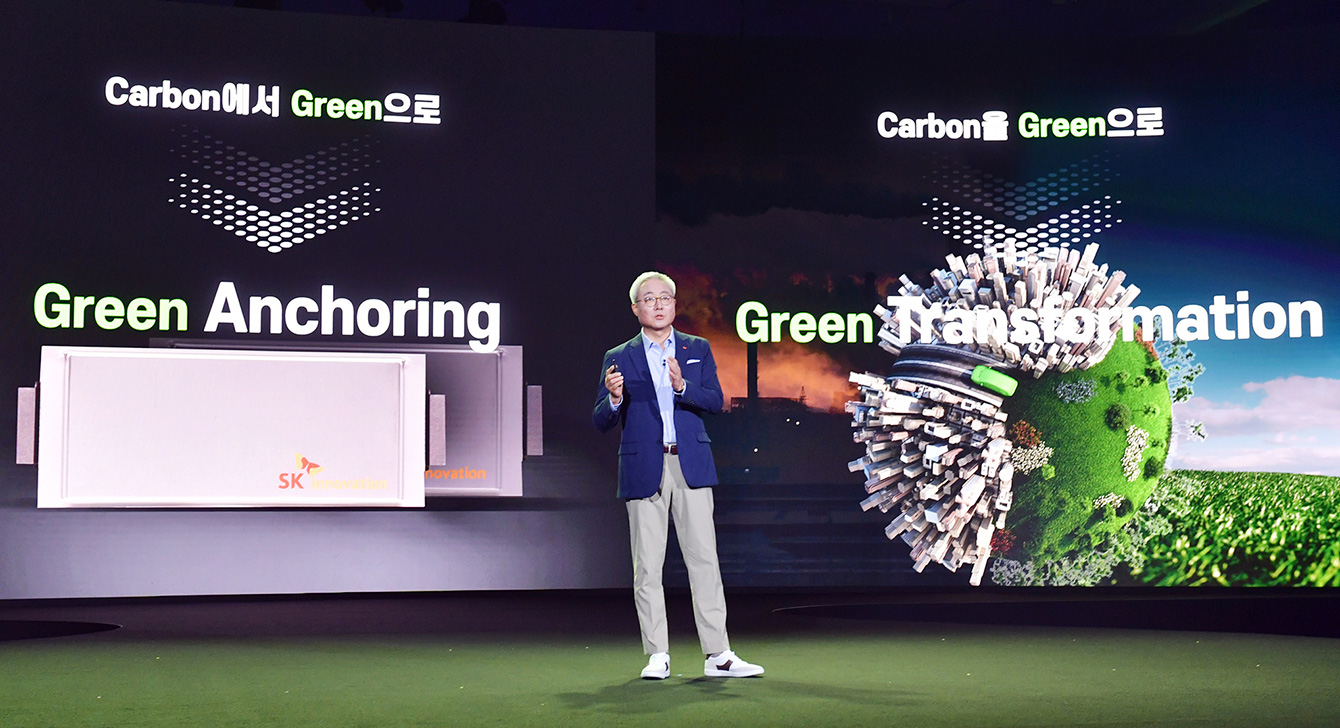

▲ CEO of SK Innovation Kim Jun revealed the company’s strategies at “SK Innovation Story Day” event held at the Conrad Hotel in Seoul, South Korea on July 1st

The budding electric vehicle (EV) market is pushing making major automakers and countries to increase investment in electrification more than ever. China, the largest car market in the world, is also engulfed in the wave of electrification, sparked by its goal of growing EV sales to 20% of all car sales by 2025. Also, a number of startups enter the market with the ambition of becoming the next Tesla. In Europe, where traditional auto heavyweights exert their influence over the market, the European Commission (EC) of the European Union (EU) has recently announced its “Fit for 55” legislation package for GHG reduction, which requires to put a dent in the sales of internal combustion engine vehicles to 100% compared to the current level by 2035.

The turning point of the automobile industry is also evident in another mega-market: the U.S. The Biden administration plans to significantly increase the federal tax incentives, which are currently paying $7,500 per unit to 200,000 units per brand, by the end of this year. According to Marklines, a research institute specialized in the automobile industry, in 2020 a total of 249,000 units of EVs were sold in the U.S. This number is significantly lower than those of Europe and China, with 661,000 and 935,000 units sold respectively. Especially, considering that about 205,000 of total 249,000 units accounted for Tesla, it is not hard to tell that the formation of the EV market is very slow in the U.S. Nevertheless, it can also be interpreted that there is a great opportunity for rapid growth in a short period of time. In fact, large automobile manufacturers such as GM and Ford are aggressively investing in EV development. GM has already announced that it will increase its EV sales to one million units by 2025, and Ford has also released its plan to convert 40% of sales to EVs by 2030.

The electrification of the automobile industry serves as a tremendous catalyst to the expansion of its core part – the battery industry. Though automakers have tended to internalize the technology and production of their core parts such as engines and accelerators, it is not the case with EV. Even after the Dieselgate, many automakers maintained their traditional stance in EV development, which was limited to the purpose of responding to the regulations on CO2 emissions. As a result, not the automakers but the companies that specialized in the large battery are the ones that had chances to preemptively dominate the EV battery market.

However, battery makers are struggling to maintain their current marketability with explosive demand. It is the precondition for them to have an environment to sustain aggressive investment. As it is a flourishing market, the emergence of competitors is inevitable. A good example is the major governments’ adoption of pump-priming measures for their battery industry and automakers’ penetration into the industry. In particular, some of the large automakers like VW and Daimler started to partially internalize battery cell production and they do not bear much financial burden in securing their self-production capacity thanks to their smooth cash flow. The market situation can be described as something like this: a customer of a battery maker can later turn into a competitor in the long run. Therefore, the battery makers have no alternative but to achieve an economy of scale by elevating their production capacity based on aggressive investment for at least three years and widening the gap with the latecomers by securing the next-generation material technology.

It will in due course lead to a decision-making system, the pertinent manpower and the amplification of financial slack specialized in the battery business. The great shift in the automobile industry is clearly demanding innovation at the level of the supply chain, and to preemptively respond to the phenomenon, it is ineluctable to switch to a concentrated business structure. As shown in the cases of Delphi and Autoliv, since some years back, the Tier-1 part companies have been frequently engaged in separating the business divisions to heighten the intensity of business structure. Recently, Korean battery makers have also also undergoing business divisions in full swing. As for SK Innovation, the company announced its intention to make a physical division of its battery business. It is seen as a timely decision of the company to preoccupy the EV market, and the direction after the physical division can be approached from three perspectives as follows.

Firstly, the sky rocking battery demand by global automakers observed from the last year provides the company with the optimum environment to enlarge the gap between SK Innovation and latecomers. There are only a few suppliers that automakers can choose in the course of future strategies for EVs. While more new battery makers may emerge in the market later, SK innovation is one of the few partners that automakers can cooperate for mass production of EVs in 2024 to 2025. The accumulated 1TWh order backlog is compelling evidence of the company’s position in the global market. On the other hand, from the standpoint of SK Innovation, a partnership with global automakers such as Ford is both an opportunity and a key to the future, so achieving operating leverage based on this will surely a prior task to be completed.

If we take the joint ventures with Ford in the U.S. and in Europe into account, SK Innovation’s EV battery production capacity is expected to reach 240GWh. The only matter is how to secure a mega-fund of KRW 11 trillion. As the business is just on track, the best possible way to secure the fund would be from external financial resources than from operating cash flow.

Secondly, the division of the battery business may lead to the setting that allows the company to focus on its own prowess – material technology. The way to get ahead of foreign companies that lag behind SK Innovation in terms of material internalization is to reinforce its price competitiveness by internalizing core materials such as separator film, copper foil, cathode materials, and others while conducting an advanced development for the next-generation material technologies such as silicon anode materials, and solid-state battery along with the current high-Ni cathode materials.

The spinoff of the battery business division leaves SK Group to form a vertical integration ranging from materials, cells and to module production with SK IE Technology, SK Materials, and SKC, and it will sharpen the Group’s competitive edges far superior to any competitors in the industry with regard to a concentrated decision-making system and cost competitiveness.

Third, separated management through physical division allows companies to establish reasonable management goals and expect the additional ascendence of the total corporate value with consistent growth of each business division through realistic capital redistribution. Petrochemical and battery industries diverge from one another so as their profit cycles. Thus, it is necessary to maximize profits by devising different business plans well suited to respective environments. It is the optimum condition to satisfy not just the company’s major stakeholders such as shareholders and employees but also suppliers in the value chain.

Along with the EV market, the fully-fledged global competition of batter makers has just begun. We have heard enough fanfare to usher in the full expansion of the EV market in major regions including the U.S. Now it is the turn for South Korea, a powerhouse of automobile and material industries. The recent move of SK Innovation will definitely mark the first step toward seizing leadership in the global EV battery market.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin