Financial Results

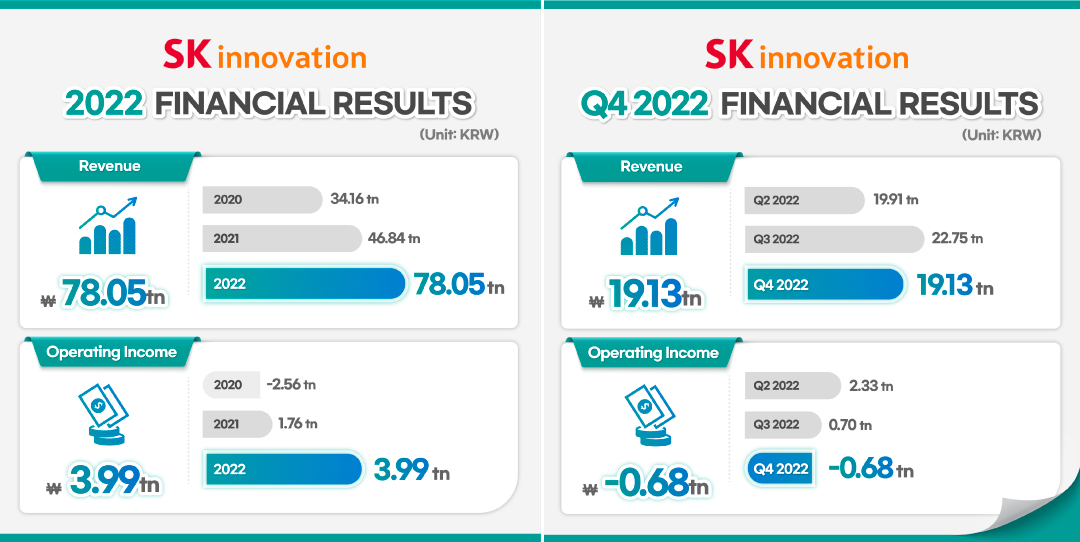

Financial Results■ SK Innovation recorded all-time high annual revenue and operating profit for 2022; Great performance improvement compared to 2021 due to the rise in oil prices and improved refining margin

– Refining business created profits by expanding overseas revenue of high-margin products through making use of the highly volatile market conditions; Lubricants business accomplished record-high annual operating profit of KRW 1.712 trillion

– Battery business achieved the highest quarterly revenue of all time, KRW 2.8756 trillion; Expected to maintain the growth in revenue by the ramp-up of new overseas production plants

■ Q4 2022 financial results recorded KRW 19.1367 trillion in revenue and KRW 683.3 billion in operating loss; A drop in oil prices and an inventory-related loss turned the performance into the red

■ For 2023, expecting a steady performance in the refining business and a recovery of the petrochemical business; The battery business expects to enjoy benefits worth KRW 4 trillion from the Inflation Reduction Act (IRA) up to 2025

– Battery business expects to complete its production capacity expansion in the US by 2025; Anticipating a strengthened market position in the US market

Despite the deficit in Q4, SK Innovation achieved record-high annual performance. Compared to 2008 and 2011 when the oil prices surged above USD 100, SK Innovation recorded the highest revenue ever in 2022, bolstered by the business expansion of the battery and materials businesses.

On February 7, SK Innovation announced its earnings report, stating that it recorded annual revenue of KRW 78.569 trillion and an annual operating profit of KRW 3.9989 trillion in 2022. For the YoY revenue and operating profit, the company achieved all-time high figures in both, as revenue increased by KRW 31.2035 trillion and operating profit increased by KRW 2.2572 trillion.

Regarding the company’s Q4 2022 performance, it recorded revenue of KRW 19.1367 trillion and operating loss of KRW 683.3 billion. When it comes to the QoQ revenue, the Q4 revenue were reduced by KRW 3.6167 trillion, and the operating profit was turned into red figures. In comparison to the same quarter in the previous year, it recorded a revenue growth of KRW 5.415 trillion while the operating loss increased by KRW 621 billion.

SK Innovation explained, “Although Q4 2022 recorded operating loss caused by the drop in oil prices, an inventory-related loss, and reduced refining margin, the company accomplished its record-high annual operating profit.” “The momentum of high oil prices which continued until the first half of last year improved refining margin in line with increased demand in oil products, and significant increase in export volume of the oil products contributed to the annual performance improvement compared to the previous year.”

Last year, the export of oil products ranked second on the list of major export products, a significant leap from 5th place in 2021. SK Innovation’s oil product export volume in 2022 reached 140 million barrels, a YoY increase of 37.7%. The 2022 export performance (including the revenue of overseas corporations) of SK Innovation’s refining, petrochemical, lubricants, battery, and battery materials business areas accounts for 72% of the company’s total revenue.

The market conditions in 2023 are expected to be highly volatile due to a mixed outlook of concerns about the recession and expectations on China’s re-opening. Nevertheless, international oil prices and geopolitical issues are expected to lead to structural undersupply, which becomes a factor for high oil prices and refining margins. Once the US government announces detailed enforcement regulations regarding the Inflation Reduction Act (IRA), the battery business is expected to be the act’s beneficiary, as it will enjoy tax credits worth about KRW 4 trillion up to 2025.

■ 2022 Financial Results

In terms of the annual performance by business, the refining business saw revenue of KRW 52.5817 trillion and an operating profit of KRW 3.3911 trillion. The petrochemical business recorded revenue of KRW 11.269 trillion and an operating profit of KRW 127.1 billion. The lubricants business reported revenue of KRW 4.9815 trillion and an operating profit of KRW 1.712 trillion. The E&P business reported revenue of KRW 1.5264 trillion and an operating profit of KRW 641.5 billion. The battery business recorded revenue of KRW 7.6177 trillion and an operating loss of KRW 991.2 billion. The materials business recorded revenue of KRW 235.1 billion, and an operating loss of KRW 48 billion.

For the outlook of market conditions for refining and petrochemical businesses, steady market conditions are expected due to the stabilized COVID-19 situation in China and the recovery of actual demand in China’s domestic market. In particular, the refining margin is expected to remain elevated due to multiple factors limiting the oil supply, such as the European Union’s sanction on Russian oil products and the decision of OPEC+ to reduce oil production. The petrochemical business is expected to experience improved spreads of polyethylene (PE) and polypropylene (PP) due to China’s re-opening and the consequently improved demand. The lubricants business is likely to experience steady spreads of its products as there is a prolonged tight base-oil supply caused by sanctions against Russia.

For the battery business, sharp growth in revenue is expected due to the ramp-up (increased production output) of new overseas production plants. Moreover, the expansion of the electric vehicle (EV) market and increased demand for batteries will bolster the business’ negotiation power. Based on this factor, the business plans to continuously improve its profitability. The materials business also plans to enhance profitability by expanding revenue and securing competitiveness in production costs.

■ Q4 2022 Financial Results

In the last quarter of 2022, the company’s refining business recorded revenue of KRW 12.1538 trillion and operating loss of KRW 661.2 billion. The petrochemical business achieved revenue of KRW 2.4159 trillion, yet, it had operating loss of KRW 88.4 billion. For the lubricants business, it accomplished revenue of KRW 1.2960 trillion and operating profit of KRW 268.4 billion. The E&P business recorded revenue of KRW 327.9 billion and operating profit of KRW 116.6 billion. The battery business recorded revenue of KRW 2.8756 trillion but an operating loss of KRW 256.6 billion. The materials business achieved revenue of KRW 42.5 billion, yet it had an operating loss of KRW 4.9 billion.

Despite the fact that the refining business’ operating profit went into the red ink, caused by the decreased oil prices and inventory-related loss, the business reduced the decrease in its operating loss by making use of the highly volatile market conditions and expanding the revenue of high-margin products. For the petrochemical business, its operating profit turned into a loss caused by a reduced margin from the bearish spreads of aromatic products and increased fixed costs. The lubricants business had a QoQ decrease in operating profit due to reduced revenue volume caused by low-demand season. Even though the E&P business saw an increased revenue volume, the business’ operating profit was decreased compared to the previous quarter due to the influence of decreased oil and gas prices.

The battery business accomplished record-high quarterly revenue through the increased revenue volume due to the operation of new production plants. However, factors such as the increased fixed costs from the expanded production capacity of new overseas plants exacerbated the operating loss compared to the previous quarter. In terms of the material business, its operating profit has improved compared to the previous quarter due to the increased revenue of products delivered to clients.

In the meantime, SK Innovation decided to pay the year-end dividends for 2022, which is 30% of the payout ratio, complying with the company’s mid-term dividend policy. By considering highly uncertain management conditions, and large-scale investment and expenditures in 2023, the dividend payout will take place in the form of a dividend in kind by using the company’s treasury stocks. The final decision on the dividend payout will be made at the general meeting of shareholders.

Head of Finance Division Group of SK Innovation Kim Yang-seob said, “Amid the highly volatile situations this year, we will strive to continuously make earnings by optimizing our business operation based on the stable financial structure.” He added, “To transform the company into Green Energy & Materials Company, we plan to thoroughly develop and make investments in the green business portfolio, which is centered on clean energy production and circular economy for electrification.”

[Attached]

| 1. SK Innovation quarterly earnings (based on K-IFRS) | (Unit: KRW hundred million) |

| Q4 2021 | Q3 2022 | Q4 2022 | YoY | QoQ | |

| Revenue | 137,217 | 227,534 | 191,367 | +54,150 | -36,167 |

| Operating income | -623 | 7,039 | -6,833 | -6,210 | -13,872 |

| 2. 2022 annual earnings by business (based on K-IFRS) | (Unit: KRW hundred million) |

| Refining* | Petrochem | Lubricants | E&P | Battery | Materials** | Staff | Total | |

| Revenue | 525,817 | 110,269 | 49,815 | 15,264 | 76,177 | 2,351 | 876 | 780,569 |

| Operating income | 33,911 | 1,271 | 10,712 | 6,415 | -9,912 | -480 | -1,928 | 39,989 |

(*) Refining: SKE, SKTI, SKIPC refining business/ petrochem: SKGC, SKIPC petrochemical business

(**) Materials : Based on consolidated financial statements of SK Innovation, which removed internal transactions of SK Innovation affiliates.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin