Financial Results

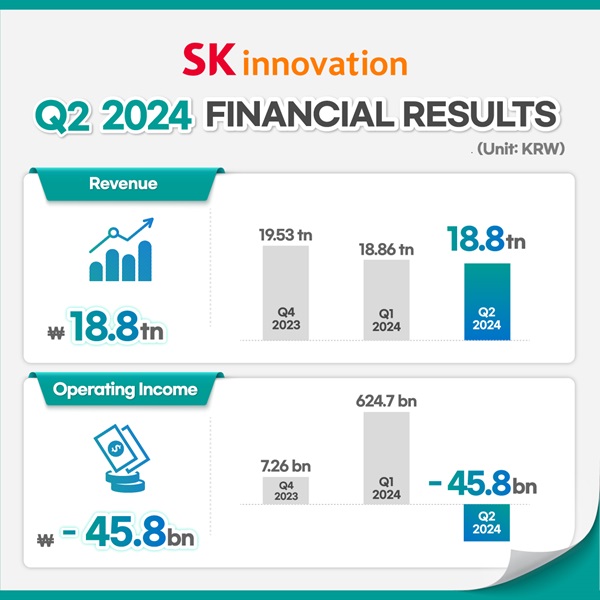

Financial Results■ Q2 results: revenue of KRW 18.8 trillion, operating loss of KRW 45.8 billion, impacted by weak refining margins and decreased battery business operating rates

■ Refining margins are expected to recover in H2, with battery demand anticipated to increase due to the expansion of new EV lineup

■ The synergy with SK E&S is expected to achieve an EBITDA of KRW 2.2 trillion by 2030, with an overall EBITDA target of KRW 20 trillion

On August 1st, SK Innovation announced its earnings for the second quarter of 2024, reporting a revenue of 37.65 trillion KRW and an operating profit of KRW 578.9 billion for the first half of 2024. Compared to the same period last year (YoY), revenue decreased by KRW 215.9 billion, but operating profit increased by KRW 310.7 billion.

For Q2 of 2024, the company recorded sales of KRW 18.8 trillion and an operating loss of 45.8 billion KRW. Revenue fell by KRW 56 billion, and operating profit saw a reduction of KRW 670.5 billion compared to the previous quarter (QoQ). However, in terms of YoY, revenue increased by KRW 71.9 billion and operating profit rose by KRW 61 billion.

SK Innovation explained, “Despite strong production performance in our petroleum exploration and development (E&P) business, operating profit for the second quarter declined compared to the previous quarter. This was due to weak refining margins in the petroleum sector and the burden of fixed costs from lower utilization rates in the battery business. Looking ahead to the second half of the year, we expect refining margins to recover and anticipate increased demand in the battery business driven by the expansion of new car lineups, which should lead to improved performance.”

■ Q2 2024 earnings by business

The refining business recorded an operating profit of KRW 144.2 billion, a decrease of KRW 446.9 billion from Q1, due to declining refining margins amid concerns over prolonged high interest rates and delayed economic recovery in China. In spite of a slight increase in the spreads of key products like paraxylene (PX) and benzene, the petrochemical business saw a drop in sales volume due to regular maintenance during Q2, resulting in an operating profit of KRW 99.4 billion, a QoQ decrease of KRW 25.1 billion.

The lubricants business recorded an operating profit of KRW 152.4 billion, a QoQ decrease of KRW 68 billion, impacted by weak demand in China. The E&P business achieved an operating profit of KRW 142.1 billion, down KRW 12.3 billion from the previous quarter, despite a slight increase in sales volume, due to lower composite sales prices and higher cost of sales.

The battery business reported an operating loss of KRW 460.1 billion, despite an increase in AMPC (Advanced Manufacturing Production Credit) from recovering sales in the U.S. region. This was attributed to lower operating rates and increased initial costs from the new plant in Hungary. Revenue for the battery business was KRW 1.55 trillion, a decrease of KRW 130.1 billion from the previous quarter. The materials business recorded an operating loss of KRW 70.1 billion, despite increased sales volumes to major customers, due to inventory-related losses.

■ Market outlook for the second half of 2024

In the second half of the year, the outlook for the refining business is positive. Oil prices are expected to be bolstered by ongoing OPEC+ production cuts and increased seasonal demand for transportation and cooling, while refining margins are anticipated to recover. The petrochemical business is expected to maintain stable PX spreads due to higher polyester demand for winter clothing, while benzene spreads are projected to exceed last year’s annual average, driven by strong demand in the U.S.

The lubricants business is expected to see improved profitability as demand for base oils and lubricants rises, driven by macroeconomic recovery following interest rate cuts. Meanwhile, the E&P business plans to bid for promising new blocks in Southeast Asia and will continue efforts to enhance the value of existing blocks in Malaysia and Vietnam.

Regarding the battery business, the stabilization of metal prices is boosting expectations for a recovery in electric vehicle (EV) demand. Increased demand is anticipated in H2, driven by the expansion of new car lineups from customers. Profitability is also expected to improve, supported by ongoing company-wide cost reduction efforts, including the optimization of production lines. The materials business is expected to see increased sales volumes with the start of shipments to new customers in North America.

■ Expected synergies from the merger of SK Innovation and SK E&S

On the 17th of last month, SK Innovation and SK E&S each held board meetings and approved the merger proposal between the two companies. If the merger is approved at the shareholders’ meeting scheduled for August 27th, the newly merged entity will officially launch on November 1st. Through this merger, the companies aim to achieve additional profitability of approximately KRW 2.2 trillion in EBITDA by 2030. This includes around KRW 0.5 trillion from the existing oil and gas business and about KRW 1.7 trillion from the electrification business.

Specifically, in the existing business, the companies expect to generate KRW 0.1 trillion by optimizing shared infrastructure such as ships and terminals, and KRW 0.4 trillion by combining SK Innovation’s LNG demand with SK E&S’s purchasing power. In the electrification business, they plan to create an additional KRW 1.7 trillion KRW in revenue by integrating SK E&S’s energy storage system (ESS) solutions and distributed generation technology with SK Innovation’s immersion cooling and battery technologies to provide energy solutions for data centers and other applications.

With this merger, SK Innovation aims to achieve a total EBITDA of KRW 20 trillion by 2030, leveraging synergies with SK E&S. This includes 2.8 trillion KRW from the expansion of LNG and power businesses and the growth of new businesses such as renewable energy and hydrogen, KRW 4 trillion from maintaining profitability in the core oil and chemical businesses, KRW 10.3 trillion from the growth of the EV battery business, over KRW 0.5 trillion from synergies in the oil and gas business, and over KRW 1.7 trillion from synergies in the electrification business.

Kim Jin-won, CFO of SK Innovation, stated, “Through the merger, we aim to strengthen our financial structure and build the capacity to prepare for the upcoming significant growth of the EV market.” He further added, “To address current challenges and improve future shareholder value, we are committed to successfully completing this merger, and will do our best to maximize the expected benefits of the merger.”

[Attached]

| 1. SK Innovation quarterly earnings (based on K-IFRS) | (Unit: KRW hundred million) |

| Q2 2023 | Q1 2024 | Q2 2024 | YoY | QoQ | |

| Revenue | 187,272 | 188,551 | 187,991 | 719 | -560 |

| Operating income | -1,068 | 6,247 | -458 | 610 | -6,705 |

| 2. 2024 Q2 earnings by business (based on K-IFRS) | (Unit: KRW hundred million) |

| Refining* | Petrochem* | Lubricants | E&P | Battery | Materials** | Staff | Total | |

| Revenue | 131,640 | 25,940 | 10,625 | 3,719 | 15,535 | 436 | 96 | 187,991 |

| Operating income | 1,442 | 994 | 1,524 | 1,421 | -4,601 | -701 | -537 | -458 |

(*) Refining: SKE, SKTI, SKIPC refining business / Petrochem: SKGC, SKIPC petrochemical business

(**) Materials: Based on consolidated financial statements of SK Innovation, which removed internal transactions of SK Innovation affiliates.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin