Financial Results

Financial Results■ SK On achieved its first quarterly profit since becoming an independent entity with operating profit of KRW 24 billion in Q3

■ SK Innovation reported an operating loss in Q3, driven by inventory losses from declining oil prices and narrower spreads in major chemical products

■ Recovery in refining margins expected in Q4, with battery sales anticipated to increase due to the operation of new car manufacturing plants in North America

■ Merger with SK E&S completed, with plans to enhance shareholder returns by securing a stable financial structure and accelerating synergy creation

SK Innovation’s battery business has marked a significant milestone by achieving its first quarterly profit, thanks to strategic efforts to enhance profitability. With the recent establishment of the merged entity, the company anticipates strengthened financial stability and improved profitability going forward.

In its Q3 2024 financial results announced on November 4th, SK Innovation reported revenues of KRW 17.66 trillion and an operating loss of KRW 423.3 billion. This represents a revenue decline of KRW 1.14 trillion and a reduction in operating profit of KRW 377.5 billion compared to the previous quarter. The decrease in operating profit is attributed to inventory-related losses due to declining oil prices and narrower spreads for key chemical products.

Despite these challenges, SK Innovation remains optimistic about the fourth quarter, anticipating a rebound in refining margins as global economic uncertainties diminish. The company also expects an increase in battery shipments, driven by the ramp-up of customer facilities in North America and the launch of new vehicle models.

On November 1st, SK Innovation finalized the merger with SK E&S, emerging as the largest private energy company in the Asia-Pacific region. With an expanded energy portfolio, the company is set to secure future growth and financial resilience. In alignment with the government’s value-up initiative, SK Innovation aims to achieve a return on equity (ROE) of 10% and a shareholder return rate of over 35% by 2027, as the merger’s benefits become fully realized.

■ Q3 2024 Earnings by Business: Operating profit in the lubricants business increased QoQ thanks to improved margins

In Q3 2024, the refining business faced challenges due to global economic slowdown concerns and reduced oil demand in China, leading to a decline in oil prices and refining margins. Consequently, the business recorded an operating loss of KRW 616.6 billion, a decrease of KRW 760.8 billion from Q2. The petrochemical business, despite increased sales volumes following the completion of paraxylene (PX) maintenance in Q2, turned into an operating loss of KRW 14.4 billion, down by KRW 113.8 billion from the prior quarter, primarily due to reduced spreads for key products and inventory effects.

On a positive note, the lubricants business experienced a growth in sales volume in the U.S. and European markets, coupled with improved margins, achieving an operating profit of KRW 174.4 billion, up by KRW 22 billion quarter-over-quarter (QoQ). The E&P business saw a slight decline in sales volume and lower composite sales prices due to falling oil prices, resulting in an operating profit of KRW 131.1 billion, down by KRW 11 billion QoQ.

The battery business reported Q3 revenues of KRW 1.43 trillion, a decrease of KRW 122.7 billion from Q2, yet achieved an operating profit of KRW 24 billion. This marks the first quarterly profit since SK On’s establishment as an independent entity in October 2021. The improvement in operating profit by KRW 484.1 billion from Q2 was driven by the base effect, including the depletion of high-cost inventory and initial costs from the Hungary plant, alongside enhanced profitability through company-wide cost reduction initiatives. In Q3, the benefit amount from the U.S. Inflation Reduction Act’s Advanced Manufacturing Production Credit (AMPC) was KRW 60.8 billion, marking a KRW 51 billion decrease QoQ. Meanwhile, the materials business faced expanded losses, with an operating loss of KRW 74 billion, due to a reduction in sales volumes for major clients.

■ Market Outlook for Q4 2024: Refining margins are expected to recover from rebounding demand and reduced supply

In the last quarter of 2024, the refining business outlook is optimistic due to expectations of easing global recession fears and the anticipated effects of reduced supply from autumn maintenance. As a result, refining margins are expected to recover. The petrochemical business is projected to see an increase in PX spreads, driven by higher polyester demand due to winter clothing needs, while benzene spreads may weaken due to new capacity additions in China. However, these spreads are still expected to remain higher than the same period last year.

Despite the seasonal off-peak period, the lubricants business anticipates achieving sales volumes similar to Q3, supported by improved domestic market conditions in China due to economic stimulus measures, with spreads expected to remain stable. The E&P business plans to continue its efforts to drill two exploratory wells in the Vietnam block and maintain production in the China 17/03 block.

The battery business foresees a slight increase in sales volumes, influenced by the operation of new car manufacturing plants in North America and the planned launch of new vehicle models by major clients in 2025. In Q4, the company plans to focus its efforts on ongoing cost structure improvements, securing new customer orders, and expanding new form factors. The materials business is expected to gradually increase sales volumes for new customers.

Kim Jin-won, CFO of SK Innovation, commented, “Through the merger with SK E&S, we have laid the foundation for establishing a stable financial structure. We will continue to enhance shareholder returns by accelerating synergy creation in the future.”

[Attached]

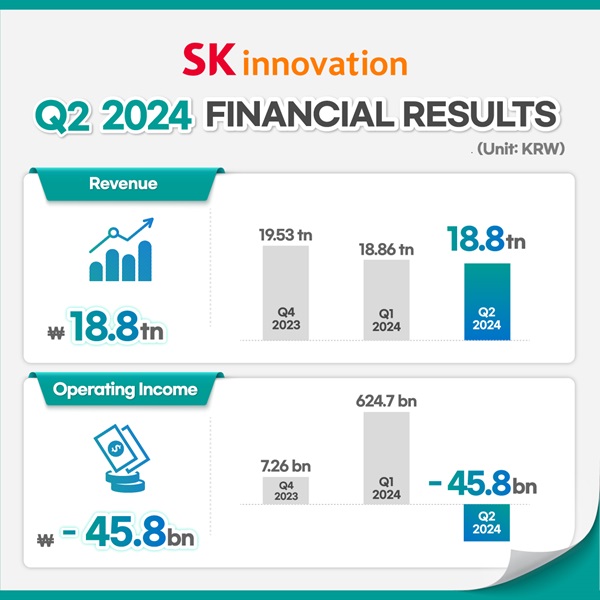

| 1. SK Innovation quarterly earnings (based on K-IFRS) | (Unit: KRW hundred million) |

| Q3 2023 | Q2 2024 | Q3 2024 | YoY | QoQ | |

| Revenue | 198,891 | 187,992 | 176,570 | -22,321 | -11,422 |

| Operating income | 15,631 | -458 | -4,233 | -19,864 | -3,775 |

| 2. 2024 Q2 earnings by business (based on K-IFRS) | (Unit: KRW hundred million) |

| Refining* | Petrochem* | Lubricants | E&P | Battery | Materials** | Staff | Total | |

| Revenue | 121,343 | 26,253 | 10,649 | 3,555 | 14,308 | 269 | 193 | 176,570 |

| Operating income | -6,166 | -144 | 1,744 | 1,311 | 240 | -740 | -478 | -4,233 |

(*) Refining: SKE, SKTI, SKIPC refining business / Petrochem: SKGC, SKIPC petrochemical business

(**) Materials: Based on consolidated financial statements of SK Innovation, which removed internal transactions of SK Innovation affiliates

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin