Financial Results

Financial Results■ Recorded KRW 11.1196 trillion in revenue, 506.5 billion in operating profit

– Continued to gain surplus with chemical/base oil margin increase and battery business profit improvement

■ Surpassed KRW 1 trillion in terms of operating profit in the first half of the year after 3 years

■ Sales in battery business rapidly increased, exceeding KRW 500 billion KRW for two quarters in a row and KRW 1 trillion KRW in the first half of a year for the first time

■ Lubricants business gained best-ever quarterly results with operating profit of KRW 226.5 billion

SK Innovation achieved an operating profit of more than KRW 500 billion for two consecutive quarters this year. Accordingly, the company’s operating profit for the first half of 2021 has exceeded KRW 1 trillion.

The main sources for the profit in Q2 2021 were its lubricants business, reaching its best sales record, and the battery business with improved profit. Its battery business earned more than 1 trillion KRW during the first half of this year; more than KRW 500 billion of revenue each quarter.

SK Innovation announced on August 4th through its performance disclosure of Q2 2021, that revenue in Q2 recorded KRW 11,119.6 billion KRW, an increase by KRW 879.8 billion KRW from Q1, thanks to increased price of oil and petrochemical products, as well as improved sales in battery business.

SK Innovation also reported that the revenue of Q2 have increased by KRW 962.8 billion compared to Q1 2020, and by KRW 4 billion compared to Q1 2021. Pre-tax profit made a turnaround with KRW 648.1 billion.

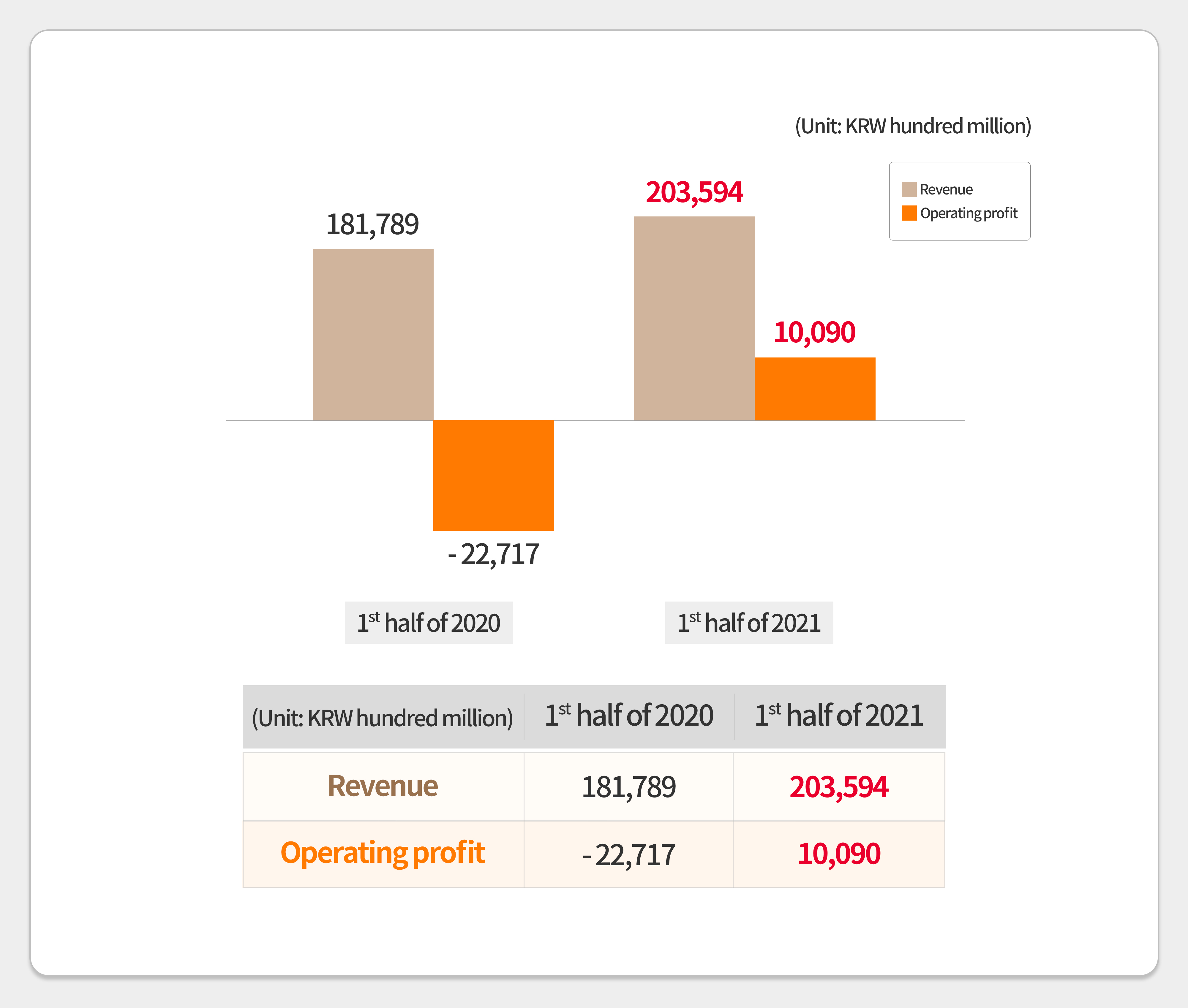

Based on these results, in terms of results in the first half of the year, sales went from KRW 18.17 trillion last year to KRW 20,359.4 billion, and operating profit turned to a surplus of KRW 1.09 trillion from an operating loss of KRW 2,271.7 billion last year. It is the first time in 3 years since 2018 that operating profit in the first half of the year exceeded KRW 1 trillion.

Refining business recorded KRW 233.1 billion of operating profit, a decrease of KRW 183 billion from the previous quarter, due to the decline in refining margins and inventory-related profits resulted from the narrowing of oil price hikes. Cracks in major petroleum products such as gasoline, kerosene, and diesel rose due to demand expectations from the spread of COVID-19 vaccine in the U.S. and Europe, but compared to the previous quarter refining margins declined due to a drop in heavy oil cracks.

Petrochemical business recorded KRW 167.9 billion of operating profit, an increase of KRW 49.6 billion from Q1 thanks to margin improvement, such as a rise in spreads in aromatics, despite decrease in sales volume and inventory-related profits due to regular maintenance of the PX process.

Lubricants business recorded KRW 226.5 billion of operating profit, an increase of KRW 89.4 billion from the previous quarter, as margins increased significantly due to tight supply and demand conditions for base oil resulted from reduced operating rate at refineries. With the highest quarterly operating profit ever since it was spinoff into subsidiary in 2009, the lubricant business has driven SK Innovation’s performance this time.

E&P business recorded operating profit of KRW 3.6 billion, down KRW 7.7 billion from Q1 due to a decrease in sales volume, despite the rise in oil and gas prices.

Battery business recorded KRW 630.2 billion of revenue, an increase of about 86% compared to the same period of 2020 (KRW 338.2 billion) thanks to the expansion of new sales volume. This record follows KRW 523.6 billion in Q1, which means for two consecutive quarters, battery business has exceeded the KRW 500 billion sales record. Also, after surpassing KRW 144.3 billion won the fourth quarter of 2018, it broke a new quarterly ales record with more than KRW 600 billion this quarter.

As a result, for the first time the battery business surpassed KRW 1 trillion in sales of the first half of a year. It was last year (2020) that the annual sales exceeded KRW 1 trillion. Considering the growth rate of SK Innovation’s battery business, such high record is expected to continue for a while, and it is interpreted that battery-centered green growth has started in full swing.

The operating loss recorded KRW 97.9 billion, an improvement of about KRW 78.8 billion from the previous quarter, thanks to an increase in sales and early stabilization of the Yancheng plant in China, which started operation this year. The operating loss recorded less than KRW 100 billion for the first time in three quarters, raising the possibility of earnings improvement in SK Innovation’s battery business in the second half of this year.

Material business recorded KRW 41.4 billion of operating profit, an increase by KRW 9.7 billion compared to the previous quarter thanks to the increase in sales volume, which is the result of additional operation of the lithium-ion battery separator (LiBS) plant in China and stabilization of production.

CEO of SK Innovation Kim Jun said, “The results of green-centered deep change and innovation that SK innovation started in 2017, are gradually becoming visible.” “While developing green businesses such as battery and materials as new growth engine, SK Innovation will keep taking strong actions to complete our Financial Story by converting existing business into green one.”

[Attached]

1. SK Innovation quarterly earnings (based on K-IFRS)

(Unit: KRW hundred million)

| Q2 2020 | Q1 2021 | Q2 2021 | YoY | QoQ | |

| Revenue | 71,319 | 92,398 | 111,196 | +39,877 (+55.9%) |

+18,798 (+20.3%) |

| Operating income |

-4,563 | 5,025 | 5,065 | +9,628 | +40 |

2. 2021 Q2 annual earnings by business (based on K-IFRS)

(Unit: KRW hundred million)

| Refining* | Petrochem* | Lubricants | Materials** | Others*** | Total | |

| Revenue | 72,466 | 23,440 | 7,628 | 959 | 6,703 | 111,196 |

| Operating income |

2,331 | 1,679 | 2,265 | 414 | -1,624 | 5,065 |

(*) Refining: SKE, SKTI, SKIPC refining business/ petrochemical: SKGC, SKIPC petrochemical business

(**) SKI-related internal transactions excluded, different from SKIET’s disclosure result|

(***) Battery business, E&P business, and staff expenses included

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin