Financial Results

Financial ResultsBattery business achieved record-high annual performance and expects to continue the improved profitability.

■ Battery business recorded revenue of KRW 12.9 trillion in 2023, a 70 percent increase compared to 2022 and expects to enhance a medium-to-long term operating rate and profitability

■ SK Innovation canceled all treasury stocks (4,919,974 shares) within the range of distributable gains and continues to “enhance the value of shareholders”

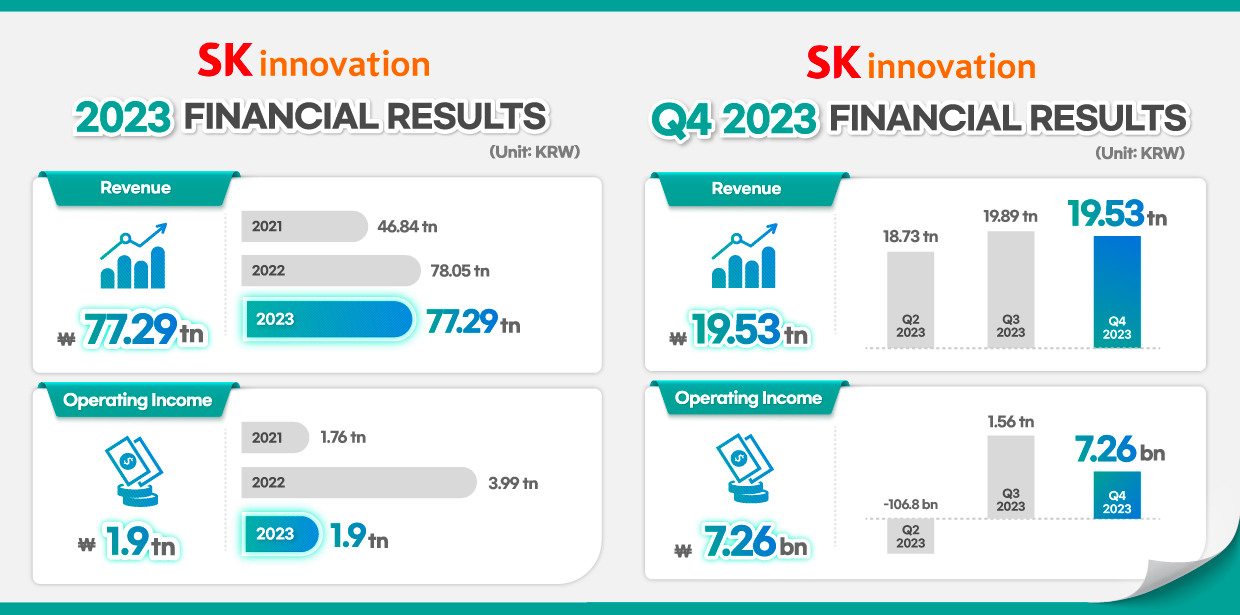

■ Recorded KRW 19.53 trillion in revenue and KRW 72.6 billion in operating profit in Q4 2023; a QoQ decrease due to a drop in refining margin

SEOUL, South Korea – SK Innovation achieved record-high performance in the battery business and continued the improvement of profitability in 2023. It also decided to retire all treasury shares to enhance the shareholders’ value.

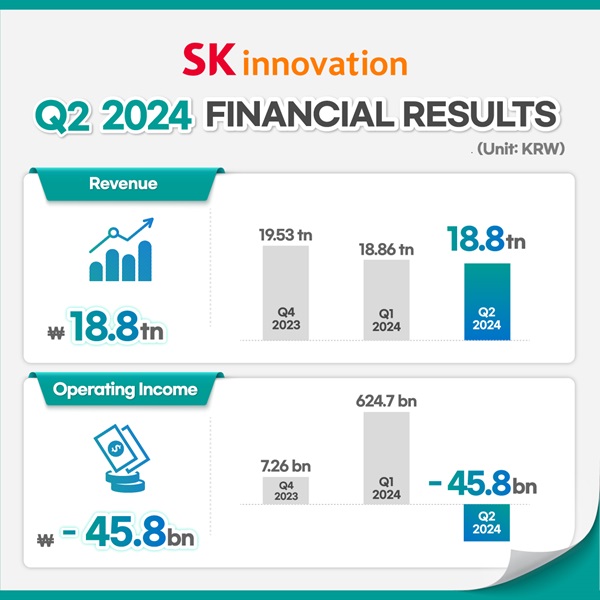

On February 6, SK Innovation announced Q4 2023 Financial Results, stating that it recorded annual revenue of KRW 77.29 trillion and operating profit of KRW 1.9 trillion in 2023. In terms of YoY performance, revenue and operating profit decreased by KRW 768.4 billion and KRW 2.13 trillion, respectively.

Regarding the company’s Q4 2023 performance, it recorded revenue of KRW 19.53 trillion and operating profit of KRW 72.6 billion. This means a decrease by KRW 359.8 billion in revenue and 1.49 trillion in operating profit QoQ. In comparison to Q4 2022, the company recorded a revenue growth of KRW 392.6 billion while the operating profit made a turnaround.

SK Innovation said, “The battery business recorded the highest revenue ever with KRW 12.9 trillion, a 70 percent increase YoY.” “In particular, as of the end of 2023, the company secured an order backlog of 2.9 TWh, which is a 1 TWh (terawatt-hour) increase compared to 2022, and is expecting to enhance medium-to-long operating rate and profitability”. “In particular, thanks to the increase of orders from existing and new customers, our order backlog has reached more than KRW 400 trillion by the end of 2023, and we are expecting an increasing mid- to long-term operating rate and profitability.”

SK Innovation decided to retire all treasury stocks acquired within the range of profit available for dividend instead of cash and in-kind dividends for the 2023 fiscal year in accordance with the board of directors’ resolution. It is the scale of 4,919,974 shares, which is equivalent to about KRW 793.6 billion based on the book value. This is a shareholder return policy that exceeds the previously announced dividend payout ratio of 30%, and the shareholder return rate including dividends and treasury stock cancellation based on 2023 performance is 319%. SK Innovation will continue to make efforts to enhance the value of shareholders in the future.

■ Q4 2023 Financial Results

The performance of each business is as follows: ▲ refining business recorded revenue of KRW 12.88 trillion and operating loss of KRW 165.2 billion; ▲ petrochemical business recorded revenue of KRW 2.45 trillion and operating profit of KRW 400 million; ▲ lubricants business recorded revenue of KRW 1.94 trillion and operating profit of KRW 217 billion; ▲ E&P business recorded revenue of KRW 310 billion and operating profit of KRW 107.1 billion; ▲ battery business recorded revenue of KRW 2.72 trillion and operating loss of KRW 18.6 billion; ▲ materials business recorded revenue of KRW 50 billion and operating profit of KRW 116 billion.

For the refining business, a weakening refining margin and an inventory-related loss caused by a drop in oil prices led to a swing to loss compared to the last quarter of 2023. The petrochemical business had a QoQ decrease in operating profit due to a reduced margin from the spreads of its products as well as fallen volume caused by routine maintenance.

The lubricant business continued a steady demand despite the low season, but it recorded a QoQ decrease in operating profit due to the inventory-related loss caused by a drop in oil prices. In spite of a decrease in oil prices, the E&P business had a QoQ rise in revenue and operating profit due to an increased revenue volume after starting to operate the 17/03 Block in China.

Despite the negative lag effect caused by a drop in metal price, the battery business improved profitability by strengthening competitiveness through improving the overall productivity of overseas subsidiaries, including improving the yields of overseas sites, and minimizing operating loss rates through cost reduction caused by corporate cost reduction and so on. For the material business, its operating profit has improved compared to the previous quarter due to improved cost including a decrease in cost of production and reflection of the incentives gained by Chinese subsidiaries.

■ 2023 Financial Results & 2024 Outlook

In terms of the annual performance by business: ▲ refining business recorded revenue of KRW 47.55 trillion and operating profit of KRW 810.9 billion; ▲ petrochemical business recorded revenue of KRW 10.74 trillion and operating profit of KRW 516.5 billion; ▲ lubricants business recorded revenue of KRW 4.69 trillion and operating profit of KRW 997.8 billion; ▲ E&P business recorded revenue of KRW 1.1261 trillion and an operating profit of KRW 368.3 billion; ▲ battery business recorded revenue of KRW 12.8972 trillion and operating loss of KRW 581.8 billion; ▲ materials business recorded revenue of KRW 192.8 billion and operating loss of KRW 11 billion.

Regarding the refining business market in 2024, refining margins are expected to be bullish due to the possibility of OPEC+ responding to additional oil production cuts and China’s economic stimulus package. When it comes to the petrochemical business, spreads of paraxylene (PX) is expected to see a gradual improvement on the strength of a high rate of continued operation by large Chinese facilities and the recovery of demand for gasoline blending. The lubricants business is also expected to experience a gradual improvement of spreads after winter and off-season. The E&P business is expected to see profit growth according to the increase in oil production at Block 17/03 in China.

The battery business is also anticipated to see a full-scale growth centering around the U.S. in the second half of 2024 with the aim of structural improvement through the focus on profitability. It will see the continued growth led by an increase in the amount shipping as well as the operation of new sites. It also aims at improving profitability in a meaningful way through the enhanced competitiveness of production cost and cost reduction. The material business is expected to strengthen mid-to-long term competitiveness by diversifying consumer portfolios in spite of uncertainty of overall demand outlook.

Kim Jin-won, Head of Finance Division Group of SK Innovation, said, “Based on fundamental business competitiveness, we will continue to create profits with stable financial structure.” “We will do our utmost to enhance the value of enterprises as well as shareholders,” he emphasized.

[Attached]

| 1. SK Innovation quarterly earnings (based on K-IFRS) | (Unit: KRW hundred million) |

| Q4 2022 | Q3 2023 | Q4 2023 | YoY | QoQ | |

| Revenue | 191,367 | 198,891 | 195,293 | 3,926 | -3,598 |

| Operating income | -7,649 | 15,631 | 726 | 8,375 | -14,905 |

| 2. 2023 Q4 earnings by business (based on K-IFRS) | (Unit: KRW hundred million) |

| Refining* | Petrochem* | Lubricants | E&P | Battery | Materials** | Staff | Total | |

| Revenue | 475,506 | 107,442 | 46,928 | 11,261 | 128,972 | 1,928 | 848 | 772,885 |

| Operating income | 8,109 | 5,165 | 9,978 | 3,683 | -5,818 | 110 | -2,188 | 19,039 |

(*) Refining: SKE, SKTI, SKIPC refining business/ Petrochem: SKGC, SKIPC petrochemical business

(**) Materials: Based on consolidated financial statements of SK Innovation, which removed internal transactions of SK Innovation affiliates.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin