Financial Results

Financial Results■ Refining margin exceeded the break-even point after hitting rock bottom, expecting a recovery in the second half of the year

– Refining business recorded operating loss of KRW 411.2 billion; petrochemical business achieved operating profit of KRW 170.2 billion (KRW 61.3 billion increased QoQ)

– Lubricants business saw a slight increase in operating profit to KRW 259.9 billion; E&P business accomplished operating profit of KRW 68.2 billion

■ Battery business continued its growth, achieving the highest quarterly revenue of KRW 3.70 trillion, while minimizing quarterly operating loss to KRW 131.5 billion

– Improvement in profitability by reflecting benefits from the US AMPC; the benefit size expected to increase significantly in the second-half of the year

– Battery business recorded revenue of approximately KRW 7 trillion in the first half of this year, about 2.8 times the revenue recorded in the first half of the previous year (KRW 2.5 trillion)

■ Plans to continue investments in future energy technologies and businesses, including hydrogen/ammonia, sustainable synthetic crude oil production through waste gasification, etc.

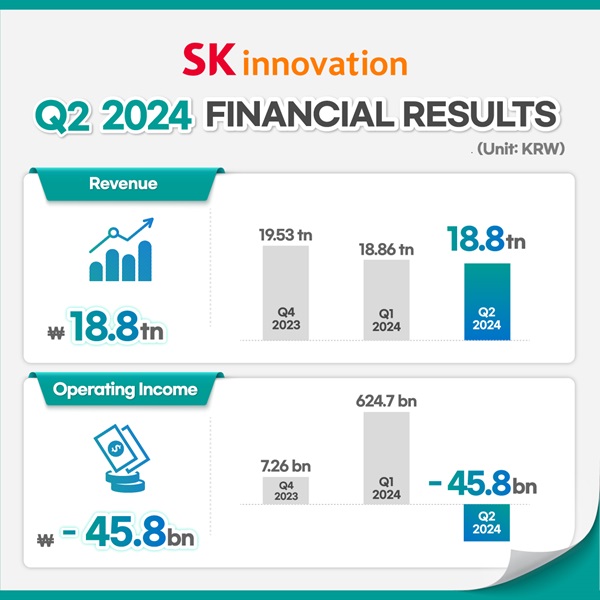

On July 28, SK Innovation announced in its Q2 2023 earnings report that it achieved revenue of KRW 18.73 trillion and operating loss of KRW 106.8 billion.

In terms of QoQ performance, the Q2 performance experienced decreases in revenue by KRW 415.7 billion and in operating profit by KRW 481.8 billion. Despite the impact on the refining business due to the fall in oil prices and refining margins amid concerns about the economic slowdown in Q2, the losses were minimized due to the solid aromatic market centered around PX (para-xylene) in the petrochemical business, improved yield from new battery production plants, and the effects of reflecting benefits from the US AMPC (Advanced Manufacturing Production Credit).

The battery business has continued its unstoppable growth as it recorded its largest quarterly revenue ever (KRW 3.70 trillion) and reduced operating loss to the smallest level (KRW 131.5 billion), the QoQ decrease by approximately KRW 210 billion, since the launch of SK On in Q4 2021. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) achieved a turnaround as it recorded KRW 72.5 billion after the Q3 of last year, which was KRW 9.4 billion.

SK Innovation stated, “The battery business achieved 12% revenue growth when compared to the previous quarter (KRW 3.31 trillion) and 187% growth compared to the same quarter of the last year (KRW 1.29 trillion). This year’s first-half revenue were about KRW 7 trillion, which is a large margin increase when compared to last year’s first half of KRW 2.5 trillion.

It added, “Moreover, there was an improvement in the operating profit and loss by incorporating the benefits from the AMPC (KRW 167 billion) during the first half of the year, and further improvement is expected in the second half of the year, driven by increased revenue volume, which will bring about larger benefits from the AMPC accordingly.

For the refining business, bolstered by a favorable business environment from the supply and demand side, including the expectation of the US’ easing of its austerity policy and the robust effect of the summer driving season, the business expects to experience an overall improvement in performance throughout the second half.”

■ Q2 2023 earnings by business

When breaking down the performance by business area, refining business recorded operating loss of KRW 411.2 billion, the QoQ decrease by KRW 686 billion, due to the impact of the decline in refining margins amid concerns about an economic slowdown. Despite the inventory-related losses due to the drop in naptha price and the decrease in by-product revenue profit, such as hydrogen, petrochemical business achieved operating profit of KRW 170.2 billion, the QoQ increase by KRW 61.3 billion, due to the solid market conditions centered on PX.

Lubricants business saw operating profit of KRW 259.9 billion, the QoQ increase by KRW 700 million, as margins improved due to the production cost reduction from lower oil prices. Despite the increase in revenue, E&P business saw a QoQ decrease of KRW 45.3 billion and recorded an operating profit of KRW 68.2 billion due to the impact of falling oil and gas prices.

Battery business achieved its highest quarterly revenue of KRW 3.70 trillion, an increase of KRW 390.8 billion from the previous quarter (KRW 3.31 trillion), and this performance was driven by improved productivity at newly launched production plants and increased revenue volume. In terms of the operating profit and loss aspect, the performance was improved by KRW 213.2 billion from the previous quarter (operating loss of KRW 344.7 billion) due to factors, such as increased revenue volume, improved yield at new production plants, and effects of the Advanced Manufacturing Tax Credit (AMPC) of the US Inflation Reduction Act (IRA).

Materials business* recorded operating loss of KRW 100 million as it reduced the loss by KRW 3.9 billion compared to the previous quarter because of increased revenue volume by major customers.

(*)It is based on the consolidated financial statements of SK Innovation, which removed internal transactions between SK Innovation’s subsidiaries. It may have differences with SKIET’s earnings

■ Market outlook for the second half of 2023

In the second half of the year, refining business is expected to experience a gradual rise in refining margins due to the anticipated easing of the US monetary tightening, the arrival of the driving season, and the recovery of travel demand, which will lead to increased demand for oil products such as gasoline and aviation fuel. Additionally, the refining margin is expected to increase gradually, due to the improved oil product supply, following the entry into the regular maintenance season in the Asian region.

For the petrochemical business, despite the ongoing supply-side burden and prolonged delay in demand improvement for PE (polyethylene) and PP (polypropylene), gradual improvement in its business conditions is expected due to the influence of demand around China’s National Day (October). For PX (para-xylene), steady performance in spreads (margin) is expected due to increased supply as large PX facilities in China restart.

Lubricants business anticipates a decline in prices as the supply of base oil eases due to the completion of regular maintenance in Asia, but it is expected to maintain steady spreads due to the driving season and increased demand during China’s re-opening.

Battery business is expected to continue its trend of revenue growth and profitability improvement with the early stabilization of new production plants and increased revenue volumes of client companies. Particularly in the second half of the year, tax credit benefits from the AMPC are expected to increase significantly compared to the first half, leading to further improvement in the business’ profit and loss. Similarly, material business is also anticipated to gradually improve its profitability by increasing revenue volumes of separators.

■ SK Innovation’s investment strategy for the future energy business

SK Innovation also revealed its business background and market outlook for future energy investments and each of its new business areas. SK Innovation recently announced in its ESG Report that it plans to invest KRW 1.79 trillion in future energy technologies and businesses by 2026.

SK Innovation is currently investing in companies with promising technologies related to future energy. These include Amogy (a company specializing in ammonia-based hydrogen fuel cell systems), Fulcrum BioEnergy (a company manufacturing sustainable aviation fuel through waste gasification), and Airrane (a company specializing in gas separation membranes). Furthermore, the company plans to continue additional investments and joint research and development in the areas of future energy using funds raised through the last month’s paid-in capital increase.

SK Innovation said, “Through strengthening our green portfolio, including batteries, and transitioning our existing petrochemical businesses to eco-friendly business models, we will continue our efforts to enhance corporate value.”

[Attached]

| 1. SK Innovation quarterly earnings (based on K-IFRS) | (Unit: KRW hundred million) |

| Q2 2022 | Q1 2023 | Q2 2023 | YoY | QoQ | |

| Revenue | 199,053 | 191,429 | 187,272 | -11,781 | -4,157 |

| Operating income | 23,292 | 3,750 | -1,068 | -24,360 | -4,818 |

| 2. 2022 Q1 earnings by business (based on K-IFRS) | (Unit: KRW hundred million) |

| Refining* | Petrochem* | Lubricants | E&P | Battery | Materials** | Staff | Total | |

| Revenue | 107,429 | 28,574 | 11,097 | 2,488 | 36,961 | 523 | 200 | 187,272 |

| Operating income | -4,112 | 1,702 | 2,599 | 682 | -1,315 | -1 | -623 | -1,068 |

(*) Refining: SKE, SKTI, SKIPC refining business/ petrochemical: SKGC, SKIPC petrochemical business

(**) Materials : Based on consolidated financial statements of SK Innovation, which removed internal transactions of SK Innovation affiliates.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin