SK Energy

SK Energy■ SK Innovation CEO & President Kim Jun announces “ruthless innovation for a happier future” in press conference

– “Negative environmental SV” connected to growth in “Green Balance” for a turning point in further growth

■ Developing e-mobility and energy solution businesses based on globally competitive batteries

– New growth industries like battery, material, and chemical businesses will take up 60% of the company‘s portfolio by 2025

– Acceleration of the “Savanna Strategy” through global expansion of oil, lubricant, and E&P businesses

■ CEO & President Kim Jun: “The final goal of our ruthless innovation is the establishment of our businesses in the African savanna and digging an oasis for the common happiness of the ecosystem. That is what we mean by pursuing EV and SV at the same time.”

SK Innovation‘s CEO & President Kim Jun has announced the plans for the “ruthless innovation” of the company. The center of this plan is accelerating the “African Savanna Strategy” to “dig the oasis for coexistence of the entire ecosystem.” This strategy represents the renewal of the company‘s strategy since two years ago in May 2017, when the company declared that the metaphorical battlefield of its management strategy no longer lies in the “Alaskan summer,” but now in the African savanna.

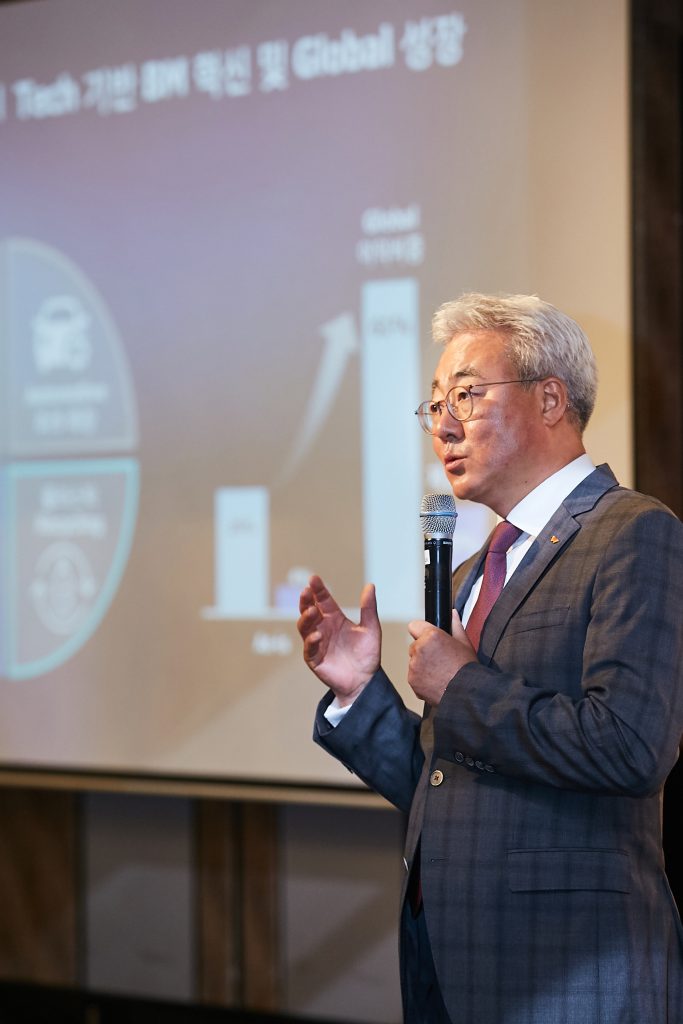

CEO & President Kim Jun, in the press conference hosted at the Four Seasons Hotel Seoul on the 27th, presented the new growth strategy of the company in a presentation titled “Ruthless Innovation for a Happier Future,” declaring that “our Deep Change 2.0 strategy has created stronger global competitiveness for our new growth businesses and conventional businesses since 2017, but we still have a long way to go,” and concluding that “we will implement this ‘ruthless innovation‘ so that all our businesses can safely be settled in the African savanna.“

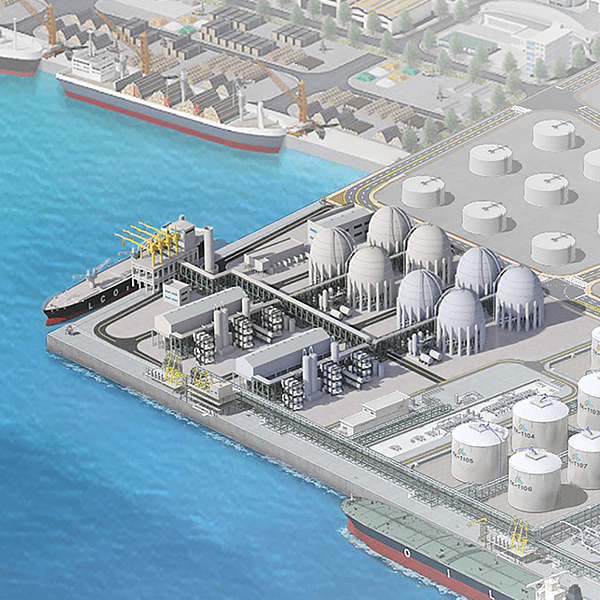

In this regard, SK Innovation explained that it had a number of significant achievements, including the global competitiveness of the battery and material business; expansion of packaging and automotive downstream in the chemical business; participation in the Petrochemical Integration Project (a project integrating E&P and petrochemical industries) of China; advanced investment in environmentally friendly industries like vacuum residue desulfurization (VRDS) in the oil business; acquisition of North American shale assets; and discovery of a new oil well in the South China-Vietnam area in exploration and production (E&P), but the increasing global competition in new businesses and the company fundamentals still heavily influenced by external factors like global oil prices drove the compay to introduce such a strategy.

CEO & President Kim added, “SK Innovation‘s environmental social value (SV) is at a negative, exceeding nearly KRW 1 trillion,” emphasizing that “this negative SV will be the center of our ruthless innovation, where we will turn this concept on the head to pursue the double bottom line (DBL) in both economic value (EV) and SV.”

SK Innovation has announced on the 21st that its environmental SV amounted to negative KRW 1.4 trillion. In other words, the company seeks to limit the negative impacts of its existing businesses and develop new, environmentally-friendly models that will allow it to achieve the “green balance,” that cancels out the negative SV in the environment and drive the growth of the company forward.

| New businesses based on competitiveness in battery and materials

SK Innovation has added a third objective in its Deep Change 2.0 strategy, the Green Initiative, which will direct the company‘s growth strategy for the near future with the other strategies of Globalization and Tech. To this end, the company has decided to strengthen the competitiveness of its battery business, a symbol of environmentalism, and use it to expand its business to e-mobility and energy solutions.

The way this would be achieved for the company‘s Battery Business is the strengthening of its technological leadership, which will allow the company to put distance between it and competitors and facilitate its ascension to the global top three by 2025. SK Innovation has decided to take the initiative by commercializing the core technology of the next-generation batteries, NCM 9½½*, and distributing it to global automobile companies. The company had successfully developed the technologies NCM622 (released in 2014, developed in 2012) and NCM811 (released in 2018, developed in 2016) for the first time in the industry in the past.

*A battery using the nickel-cobalt-manganese ratio of 90%-5%-5% and a cathode with an energy density of at least 670 Wh/l. It allows one charge to cover a distance of more than 500 km, which places it at the cutting edge of battery technology.

Through its competitiveness in development and production technologies, the company plans to expand its orders in hand from the present level of 430 GWh to 700 GWh by 2025, and its annual production from 5 GWh to 100 GWh.

SK Innovation has also decided to establish “Battery as a Service (BaaS): making batteries a new service platform”—a new type of “5R (Repair, Rental, Recharge, Reuse, Recycling)” platform that can encompass the entirety of the value chain by stepping beyond the electronic vehicle (EV) battery production-centered business structure to a vertical integration of the business—in cooperation with different business partners like EV companies. Through this platform, the company expects that it will create a new business model in the field of e-mobility by offering a unique service among all competitors. Other cooperative models with global businesses in fields outside EV, such as aviation, maritime, or industrial, were planned as well.

For the other axis of the battery business expansion, Energy Storage System (ESS), the company has decided to develop different batteries that are specialized toward specific markets like industrial or residential, and, thus, offer safe and efficient ESS systems to the market. This will serve as the basis for downstream models like Virtual Power Plant (VPP), Energy Management System (EMS), and energy saving, thereby forming the components of the company’s comprehensive energy solution.

Lithium-ion Battery Separator (LiBS) Business will expand its global production facilities in addition to the ongoing expansions in China and Poland to more than 2.5 billion m2 per year by 2025, by which the company aims to rank the first in the global market with a 30% share. Because the company has successfully established its presence in the market for Flexible Cover Window (FCW), a core component in flexible displays, FCW will serve as the basis for the expansion of the company to TV and automobile displays as it seeks to assume the leadership of the business ecosystem.

Chemical Business expansion will be centered around the two strategies of Global and Tech. Packaging, a new core business of the company, will utilize mergers and acquisitions (M&A) and other methods to acquire portfolios for high-value products in the same way that the company acquired the ethylene acrylic acid (EAA) / polyvinylidene chloride (PVDC)* portfolio, while automotive business will focus on technological development to lead the efforts for lightweight EVs and their widespread usage. These methods will help the company expand the weight of high-value product groups in its profit structure by five times, from the present level of 4% to 19% by 2025.

*Core material in the packaging business, acquired from Dow Chemical

Expansions in global partnership will allow the company to develop innovative cooperative projects like the participation of Sinopec-SK Wuhan Petrochemical Corp. in the Petrochemical Integration Project, and build environmentally friendly ecosystems between relevant companies to solve the problem of waste plastics. This strategy seeks to expand the weight of global operating profit from the present level of 24% to 61% by 2025.

SK Innovation will also continue the investments toward growth industries like battery, material, and chemical, expanding the ratio of these assets from 30% to 60% by the year 2025.

| Global competitiveness through dedication to “Savanna Strategy”

SK Innovation has decided to expand its “Savanna Strategy,” where the global technologies and capabilities of its oil and lubricant business will facilitate the transition of the company to Africa. Since the two businesses form the backbone of the company at the moment, they will continue their role as growth drivers for the rest of the company.

First of all, the Oil Business will have Tech and Green strategies in equal measure, centered around the global strategy. To this end, the company seeks to expand the outlets of its oil products in high-growth markets of Southeast Asian countries like Vietnam, Myanmar, and the Philippines. This area has already seen some progress through methods like investments, partnerships, and Netruck House rest stops.

These efforts will be followed by platform projects that turn the core assets of gas stations into shared infrastructure, efforts to optimize operation and trading by strengthening market predictions, and expanding the supply of environmentally friendly products to create the “African Savanna BM Innovation.”

The Lubricant Business will utilize the company‘s leading position in Group III base oils to expand the ongoing partnership with LABSOL, Pertamina, and JXTG to other companies, and, thus, expand the global lubricant business as well. “Tech” capabilities are the main focus, as the company seeks to lead the development for next-generation products like EV lubricants and base oil replacements. The company‘s EV lubricants are already being supplied to the market.

Exploration and Production (E&P) will focus on expansions within Asia, centered around China and Vietnam, and the North American oil shale. The company has successfully established its new strategy of direct E&P in strategic areas, rather than investments of the past. The company‘s distinguished technological advantages like 3D Seismic and quantitative seismic interpretation (QSI)* will pave the way toward greater chances of success in resource development. These technologies have already allowed the company to find oil deposits in the South China Sea last year and Southeastern Vietnam in May of this year.

*3D Seismic: Imaging technology using artificial seismic waves (elastic waves) to image the underground structure of the area. / QSI: Technology using quantitative analysis of elastic wave data to analyze the underground material and rock formations.

SK Innovation will use these global strategies to expand its global assets from 25% to 65% by 2025 in its bid to complete its “African Savanna Strategy.”

CEO & President Kim Jun has commented, “Difficult management environment and new challenges have changed the innovation DNA of our members into a ruthless one.” He continued, “The final goal of our ruthless innovation is the establishment of our businesses in the African savanna, and digging an oasis for the common happiness of the ecosystem. That is what we mean by pursuing economic value (EV) and social value (SV) at the same time.”

The press conference was attended by about 20 senior management from the SK Group, including SK Innovation CEO & President Kim Jun, SK Energy CEO & President Cho Kyong-mok, SK Global Chemical President & CEO Na Kyung-soo, SK Lubricant CEO & President Jee Dong-seob, SK Incheon Petrochem President & CEO Choi Nam-kyu, SK Trading International CEO & President Suh Sok-won, SK IE Technology CEO & President Rho Jae-sok, and SK Innovation‘s battery business division head Yoon Ye-sun.

[Photograph 1-4]

SK Innovation CEO & President Kim Jun presents the new growth strategy of the company under the title “Ruthless Innovation for a Happier Future” in a press conference held on the 27th.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin