SK Energy

SK Energy

| ※ The figures for 2018’s 4th quarter (4Q) contained within this article have not undergone external accounting review and, thus, may be subject to change. |

01| SK Innovation publishes management results for 2018

SK Innovation has published its management results for the year of 2018.

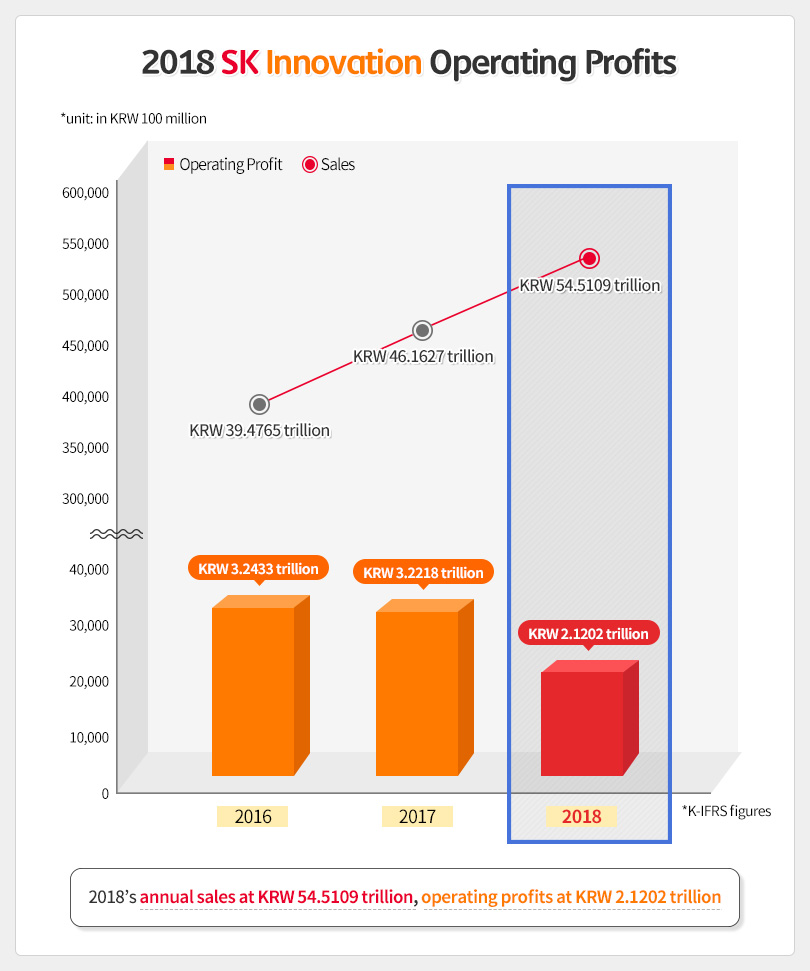

SK Innovation has published its 2018 consolidated sales of KRW 54.5109 trillion and operating profit of KRW 2.1202 trillion.

Despite the negative effects of a decrease in demand driven by the slowing growth of the global economy, a rapid drop in oil prices due to an oversupply in shale oil from United States, and a decrease in margins, SK Innovation‘s performances in 4Q 2018 was buoyed by its Deep Change 2.0 and managed to limit the losses to KRW 278.9 billion.

SK Innovation has continued building a Deep Change–based innovation of its business model to minimize the effects of outside variables like oil prices and margins to results, building consistent performances based on the differentiated competitiveness of its non-refinery businesses.

SK Innovation had also established hedge-based non-operating profits as a means of defense against the losses of profit from shifting oil prices, which had allowed the company to generate KRW 2.3804 trillion in pre-tax profits, nearly reaching 2016 levels when the company exceeded the operating profit of KRW 3 trillion for the first time.

This year‘s business results are also notable for separating the battery business of the company for the first time. SK Innovation‘s battery business recorded a net increase in the operating losses to the total of KRW 317.5 billion driven by the rapid increase in orders and the subsequent need for facility expansion, new hires, and R&D costs.

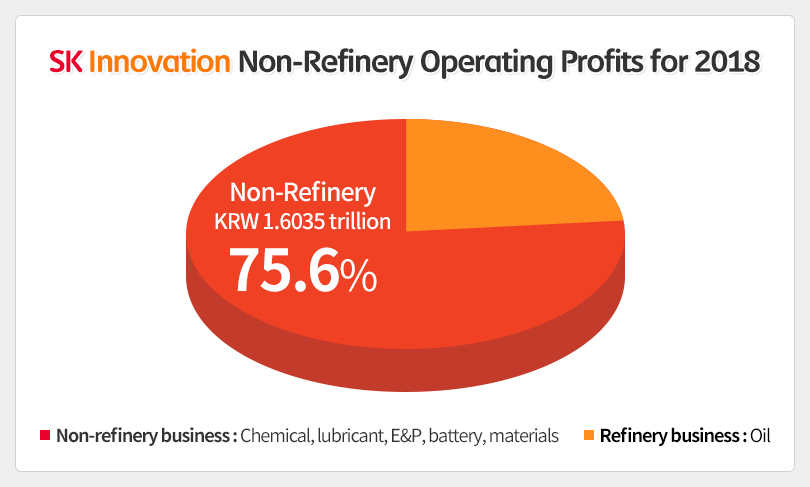

With regard to the separation of battery business from the yearly business results of the company, SK Innovation‘s non-refinery business of battery business, chemicals, lubricants, E&P, and material businesses have accounted for 75.6% of the total results in 2018. Notably, this result was achieved despite the expanding losses in battery business due to increased investments.

Despite the worsening market conditions in 4Q that resulted in the losses in the oil industry, SK Innovation‘s business model innovation and the strengthening of its businesses have allowed the company to defend the yearly business results from greater damage successfully. Based on these performances, SK Innovation will focus on investing heavily in Deep Change 2.0–based growth drivers like battery and materials businesses and snowball its profit structure even further.

Even though the general increase in oil prices has driven the increase of annual sales to KRW 6.4223 trillion, the drop in oil prices and margins in the 4Q 2018 resulted in the operating profit decreasing by KRW 788.9 billion.

The paraxylene (PX) spread has kept up a strong performance throughout the year, but other markets such as ethylene, polyethylene (PE), and benzene have suffered in performance, reducing the chemical business operating profit by KRW 259.8 billion from the previous year.

The lubricant business, despite the strong increase in demand for premium base oil, took a hit from the new facilities of competitors and inventory losses due to a rapid decline in oil prices in 4Q, ending up with KRW 460.7 billion profit and a decrease of KRW 44.2 billion from the previous year.

E&P operating profits reached KRW 255.8 billion, an increase of KRW 67.4 billion from the previous year, thanks to the general rise in oil prices across the globe.

Battery business recorded sales of KRW 348.2 billion and an operating loss of KRW 317.5 billion. Despite sales figures increasing significantly from the previous year by KRW 202.5 billion thanks to the increase in EV battery supply to European partners, the increase in orders necessitated heavy investments and new hires, which drove the operating loss up by KRW 85.4 billion (+36.8%).

The materials business recorded an operating profit of KRW 87 billion, an increase of KRW 24.5 billion (+39.2%) from the previous year.

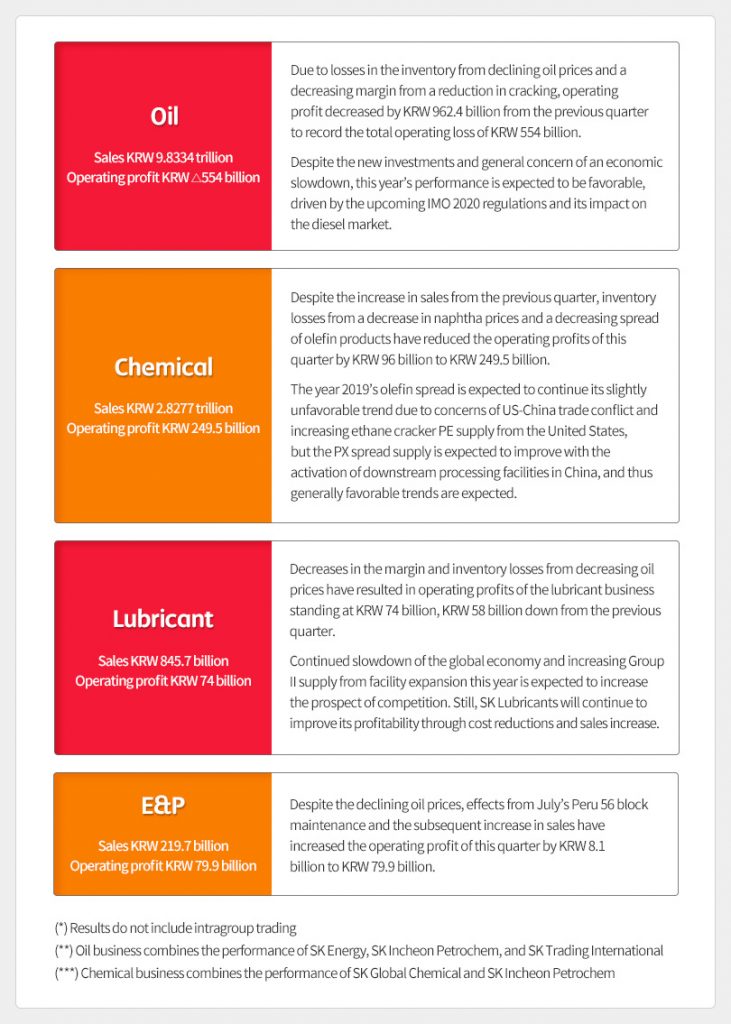

02| Business-specific results in 4Q 2018 and 1Q 2019 prospects

The 4Q 2018 sales declined to KRW 13.9481 trillion, a decrease of KRW 1.106 trillion from the previous quarter, because of declining sales of exports and a decrease in product sales margin from falling oil prices. Operating profit was likewise affected by decreases in product margin in petrochemical products and inventory losses, ending up at KRW △278.9 billion after a decrease of KRW 1.148 trillion from the previous quarter.

After July‘s interim dividend of KRW 1,600 per share to improve the investor values of the company, SK Innovation has finalized its annual dividend at KRW 8,000 per share, the same level as the previous year. Thus, the annual dividend for the year 2018 after interim dividend stands at KRW 6,400 per share.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin