SK Energy

SK Energy■ SK Energy and SK Trading International acquire a 35% stake in BOC, the second-largest oil distribution group in Myanmar

■ Achievement of a strategy to preemptively enter growing Southeast Asian markets following the acquisition of a stake in Vietnam’s PV Oil in 2018

■ SK’s oil business operation know-how will help maximize management performance

SK has acquired stakes in overseas oil distribution companies to expand its presence in the local market.

SK Innovation said its oil business subsidiary SK Energy (CEO: Cho Kyong-mok) and SK Trading International (CEO: Suh Sok-won) signed a contract on July 18 to acquire shares of Best Oil Company (BOC), Myanmar’s second-largest oil distribution group.

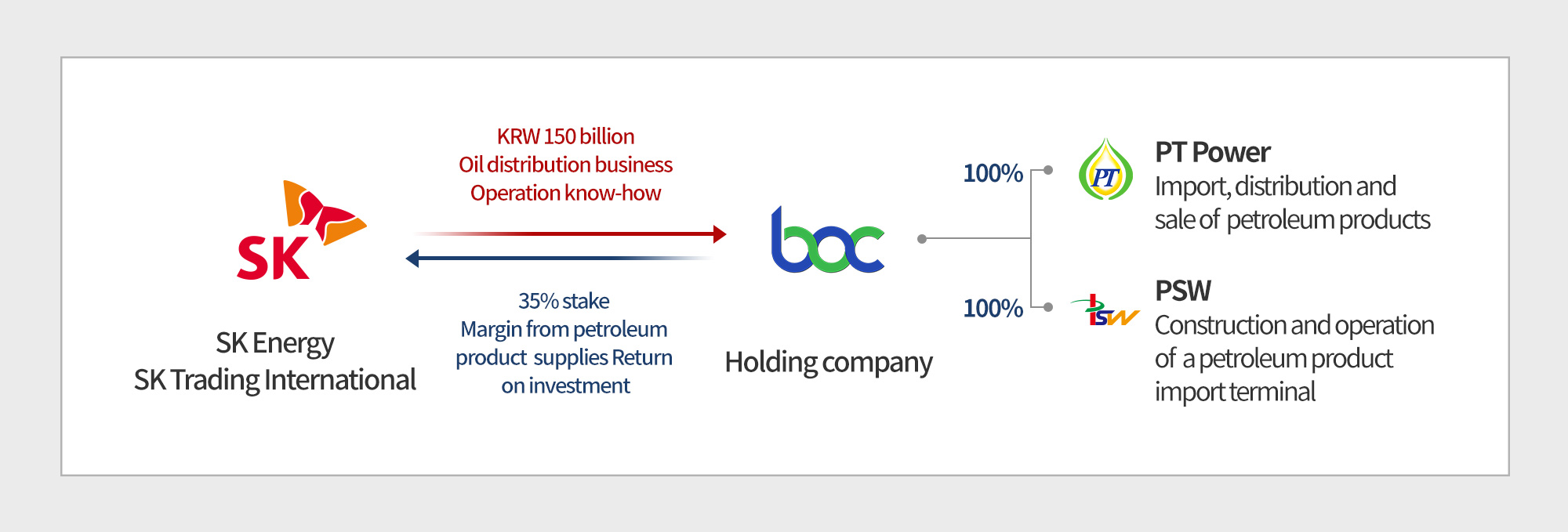

BOC, an oil distribution holding company, has PT Power, responsible for oil imports and distribution in southern Myanmar, and PSW, which builds and operates an oil product import terminal, as its 100% subsidiaries. BOC has a 17% share in Myanmar’s oil market. Through this deal, SK will secure a total of 35% stake, with SK Energy and SK Trading International holding 17.5% each. The investment is worth about KRW 150 billion.

More than 500 people attended the contract signing ceremony held on this day at Lotte Hotel Yangon, Myanmar, including SK Energy CEO Cho Kyong-mok, SK Trading International CEO Suh Sok-won, BOC Chairman Aung Shwe, and BOC CEO Win Swe.

Suh Sok-won, CEO of SK Trading International, said, “This is a strategic investment to secure a stable export and trading market and enter overseas retail markets to create growth opportunities.”

SK Energy and SK Trading International have set their eye on the Southeast Asian oil market, which has recently seen explosive growth, in pursuit of various investment opportunities. As SK Energy succeeded in investing in Myanmar after securing a 5.23% stake in Vietnam’s PV Oil last year, the company’s strategy to preemptively enter the market with high growth potential and gain a competitive edge appears to bear fruit. It is the first time for a Korean refiner to invest in an overseas oil distribution company. Through this investment, SK will be able to expect margins from petroleum product supplies as well as a return on investment from business growth.

Myanmar is growing rapidly after the transition to a civilian government in 2011 and the relief from U.S. economic sanctions in 2016. The country is located in a strategic hub that borders the Indian Ocean and connects the large markets of China and India. It also has the potential to grow into an emerging production hub and consumer market with abundant low-wage labor and resources. Between 2013 and 2017, the average annual GDP growth rate was 7.2%.

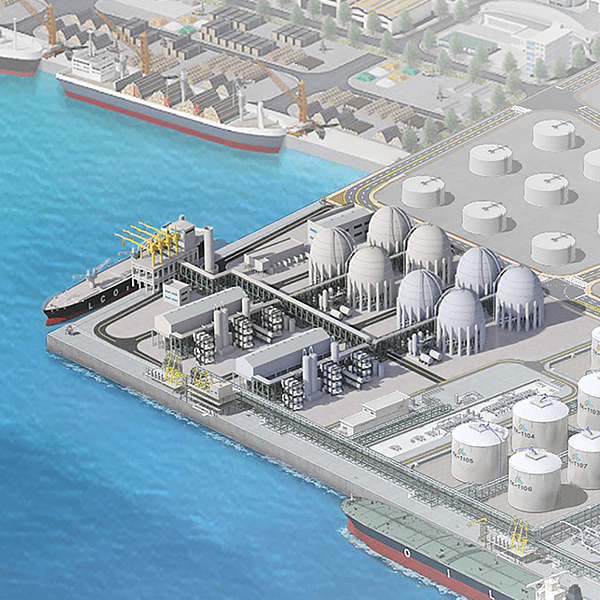

In addition, demand for petroleum products is expected to grow at an annual average of 10% by 2025 due to the surging number of automobiles on the back of the import liberalization measures in 2012 and the increasing demand for industrial diesel following industrial growth. Therefore, the oil market is forecast to generate stable profits in the future.

“We will make a success story of maximizing the performance of partner companies by leveraging SK’s world-class oil business operation know-how,” said SK Energy CEO Cho Kyong-mok. “Based on this, we will further expand SK’s presence in the Southeast Asian market.”

[Reference] SK-BOC investment and cooperation structure

[Photo Description]

(From left) SK Trading International CEO Suh Sok-won, SK Energy CEO Cho Kyong-mok, BOC Chairman Aung Shwe, and BOC CEO Win Swe pose for a commemorative photo after signing an agreement during the SK-BOC Partnership Signing Ceremony held at Lotte Hotel Yangon in Myanmar on July 18, local time.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin