SK Geo Centric

SK Geo Centric■ On November 15, SK Geo Centric signed a sustainability-linked loan (SLL) contract with five global banks, including BNP Paribas.

■ Linking the company’s ESG management goals, such as plastic recycling, with financial agreements, SK Geo Centric concluded on favorable terms in a difficult financial environment.

■ Relevant goals and action plans to be posted and updated on the company website soon with their progress.

■ “We will promote eco-friendly business and create social value to become a leader in the circular economy,” said Na Kyung-soo, CEO of SK Geo Centric.

SK Geo Centric has set goals and action plans for eco-friendly businesses, such as plastic recycling, and has raised a total of KRW 475 billion on Sustainability-Linked Loans (SLL) from global banks in the current difficult financial environment. The global financial market recognized SK Geo Centric’s goal of “Earth-centered eco-friendly innovation” and its passion for ESG management.

This SLL is the first successful case in Korea that has been verified by Det Norske Veritas (DNV), an international external certification body. DNV stated that the goal of SK Geo Centric’s SLL was highly ambitious and judged that the target level was feasible and met global standards. SK Geo Centric submitted the eco-friendly management goals verified by DNV to banks and received positive reviews.

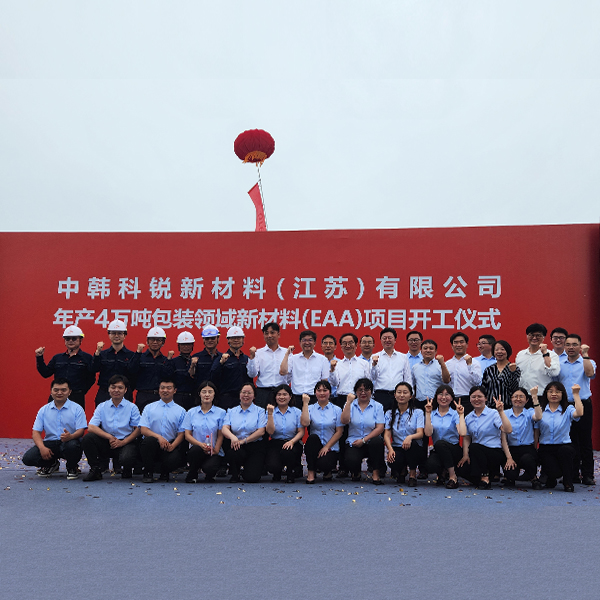

On November 15 (KST), SK Geo Centric announced that it signed a 3-year SLL with a lender group of five global financial institutions: BNP Paribas and Crédit Agricole CIB (France), Bank of China and Agricultural Bank of China (China), and MUFG (Japan) .

The signing ceremony held at the SK Building in Seoul, was attended by Na Kyung-soo, CEO of SK Geo Centric, Kim Yang-seob, Head of Finance Division Group of SK Innovation, and key executives of the five global banks. SK Geo Centric plans to use the secured funds to expand the ESG business in the Advanced Recycling Cluster in Ulsan, which will be built in 2025 as the first of its kind in the world. The Advanced Recycling Cluster will be built on a 215,000 square meters (about the size of 22 soccer fields) site within Ulsan CLX and will be able to recycle about 250,000 tons of plastic waste per year.

An SLL is a type of the ESG capital raising method that links the company’s ESG management goals with loans from financial institutions. This is mainly done by companies and banks in developed countries. A lower interest rate than regular loans is applied to an SLL, and additional preferential interest rates are provided when ESG management goals are achieved. The scale of global ESG financing, including SLL, increased from $238.5 billion in 2018 to $1.5706 trillion last year, showing rapid growth. Some of the world’s leading companies, including Henkel, a global household and industrial products company, have also initiated SLL.

The two goals set by SK Geo Centric in connection with the SLL are to increase the plastic recycling scale (900,000 tons by 2025) and reduce greenhouse gas emissions (24.9% reduction by 2025 compared to 2019). SK Geo Centric started reviewing the SLL from the beginning of this year. Considering the recent surge in interest rates and the difficulties companies are experiencing in raising funds, it is meaningful that the company successfully raised capital on favorable terms by linking it to ESG goals.

In the future, the lender group will verify the level of achievement of the set goals and adjust the interest rate accordingly. The lender and SK Geo Centric will continue to work together so that the funds can be used for mutually agreed eco-friendly areas. SK Geo Centric plans to disclose related goals and plans on the company website and continuously check the level of achievement.

“It’s very meaningful that a large-scale financing on a sustainability-linked loan has been raised for our eco-friendly business, such as recycling of waste plastics, for the first time in Korea through verification by a global certification body,” said Na Kyung-soo, CEO of SK Geo Centric. “SK Geo Centric will carry out eco-friendly business and social responsibility at the same time, expanding its position as a global market leader in the circular economy field,” he emphasized.

“What makes an SLL so special is that banks and companies cooperate in the process of achieving ESG goals,” said Philippe Noirot, Head of Territory, BNP Paribas Korea. “We will work hard together to make SK Geo Centric grow into a leading eco-friendly company by solving the problem of waste plastics,” he added.

[Photo]

(Photo 1, 2) BNP Paribas Seoul Managing Director Seo Jong-gab, BNP Paribas Korea Head of Territory Phillipe Noirot, CEO of SK Geo Centric Na Kyung-soo, SK Geo Centric Head of Strategy Division Choi Ahn-seop take commemorative pictures after the Sustainability-Linked Loan (SLL) signing ceremony.

–SK Geo Centric to build Advanced Recycle Cluster in Ulsan by 2025

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin