Trends & Reports

Trends & Reports

| New milestone: an electric model became the best-selling car in Europe market for the first time

In recent year, it is no longer or shocking news that corporates declared carbon neutrality declarations, and governments announced related policies to achieve Net Zero target one after another. Consequently, more and more electric vehicles are running on the roads of China, Europe, and the U.S., where governments have been taking strong actions to reduce vehicles that emit large amount of Greenhouse Gas (GHG). However, it is not until September 2021, when it marks the first time an electric vehicle (EV) became the best-selling car in Europe, a market where most famous automakers are located.

JATO Dynamics, a global supplier of automotive business intelligence solutions, titled a press release on October 25th “EV revolution hits new milestone as Tesla Model 3 becomes Europe’s best-selling car in September” to highlight this event. After showing the September sales number of Tesla Model 3 in Europe, which is 24,591 units, JATO Dynamics emphasized “This is both first time that an EV has led the market and the first time that a vehicle manufactured outside of Europe has occupied the top spot.” The report also showed the ongoing surge of low emission vehicles in Europe with a monthly growth of 44% to 221,500 units, while the number of newly registered diesel vehicles decreased by 51% to 167,000 units. Felipe Munoz, Global Analyst at JATO Dynamics, commented: “In addition to incentives, OEMs have enhanced their offering with more models and better deals, and many are shifting their limited supply of semiconductors to the production of EVs, instead of ICE (internal combustion engine) vehicles.”

Along with the undeniable growth of EVs in Europe, the EV battery business is also booming and expected to grow fast. Based on a report published in October 2021 by Fortune Business Insights, the global EV battery market is expected “to grow from $27.30 billion in 2021 to $154.90 billion in 2028 at a CAGR of 28.1% in forecast period.” Consequently, growth is anticipated in the battery separator market as well. Global Market Insights published a study in March this year predicting that the world’s battery separators market size “will showcase a growth rate of around 16.1% CAGR from 2021 to 2027.

| SK Innovation’s strategies to win the European market

SK Innovation has long anticipated the growth of the European EV market and continues to make preemptive investments such as building core production bases in European countries, including Hungary and Poland, through its subsidiaries, living up to its reputation as a leading company in EV battery and materials business.

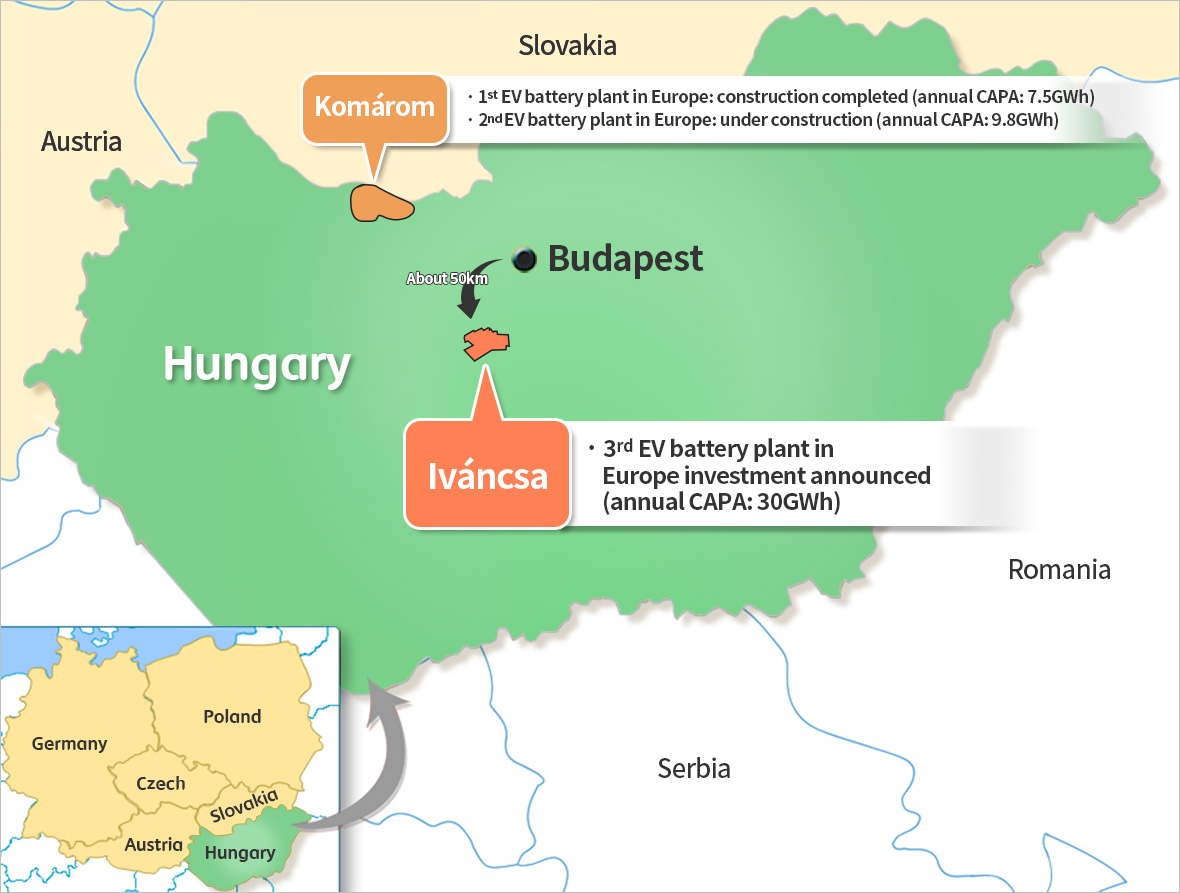

SK On to build the 3rd plant to expand its battery production bases in Europe

In an endeavor to extend the battery production base in Europe, SK On, SK Innovation’s battery business subsidiary, decided to build the third European plant in January this year. The 3rd plant will be built in Iváncsa, Hungary with an annual production capacity of 30GWh(*) and its ground work and design are in progress. In terms of investment size, it is the biggest of all SK On’s battery plants built in Europe. The third European plant is a long-term project in which the investment will be undertaken in a series by 2028 and a total of USD 2.29 billion. (KRW 2.6 trillion) will be invested.

(*) Based on 70kWh, capacity to be mounted on an electric car that can travel over 400km on a single charge, able to supply about 430,000 units.

▲ Location map of SK On’s EV battery plants in Europe

The first and second European plants are also located in Komárom, Hungary. SK On invested approximately KRW 850 billion to construct the first EV battery plant with an annual production capacity of 7.5GWh, which began producing EV batteries in January of last year.

The company is currently constructing a second plant with an annual output capacity of 9.8GWh for a total investment of KRW 945 billion, with intentions to finish construction this year and begin commercial operations the following year. The Hungarian government also provided SK On with a subsidy of EUR 90 million. (about KRW 120.9 billion) for the construction of the second plant in this project. It signifies that the Hungarian government has recognized the sheer benefits of the second plant’s operation, such as economic effects and job creation.

▲ SK On’s EV battery plant 1 (left) and plant 2 (right) in Hungary

SK IE Technology to target the battery material market by securing the European production base

Last October, SK IE Technology (SKIET), SK Innovation’s information and electronic materials business subsidiary, had an opening ceremony for the Lithium-ion Battery Separators (LiBS) plant in Poland, its first European production base, kicking off a full-fledged expansion into the European market.

After completing mechanical construction in June, SKIET’s first Polish facility in Silesia Province, Poland, began commercial operations in August and will phase in its production scale. It makes SKIET the first company to set up a local separator production base in Europe, a growing significant market in the global EV market, and the company plans to supply its products to global battery manufacturers such as SK On.

▲ (Left) Ambassador of the Republic of Korea in Poland Sun Mira, Polish Deputy Minister of Economic Development and Technology Grzegorz Piechowiak, and CEO of SK IE Technology Roh Jae-sok attend the completion ceremony of SKIET’s first separator plant in Poland on October 6, 2021 / (Right) SKIET’s first separator plant in Poland

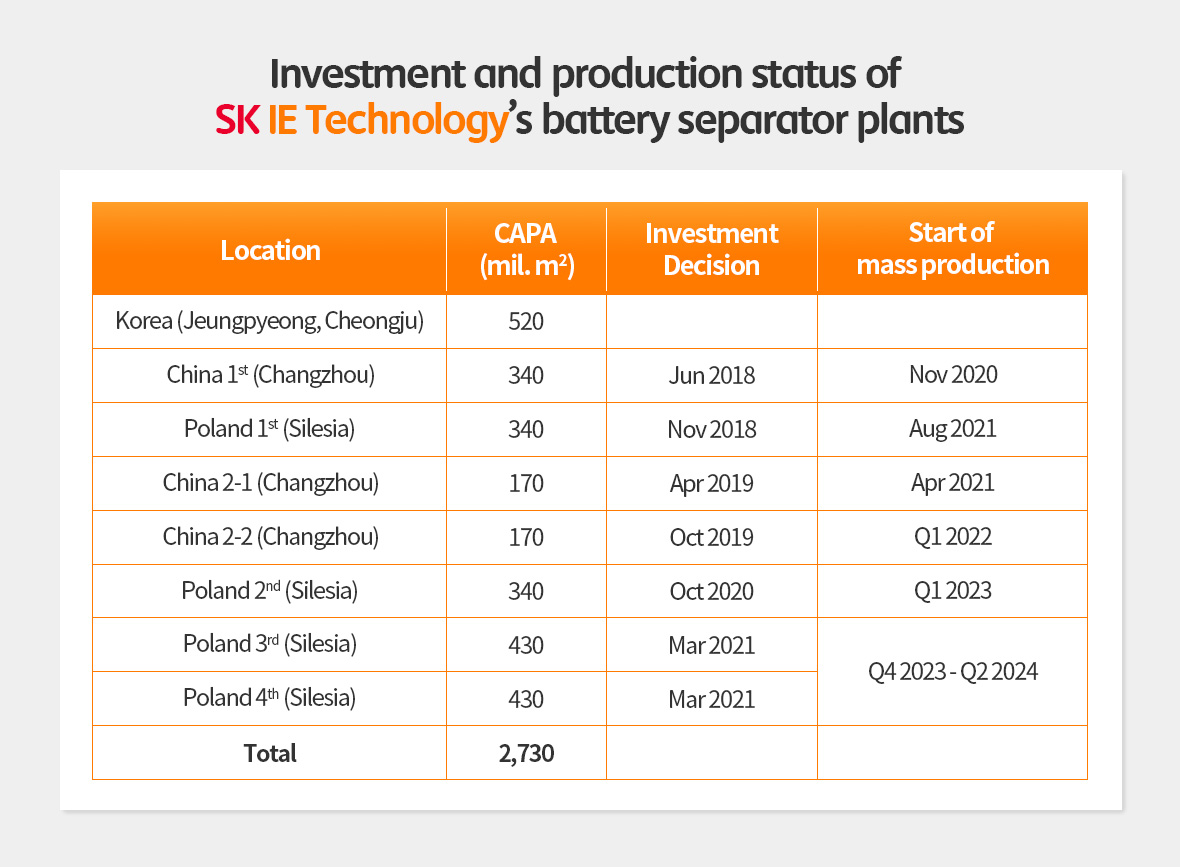

By 2024, SKIET plans to invest a total of KRW 2 trillion in Silesia Province, Poland, to achieve a separator production capacity of 1,540 mil. m2, the largest in Europe. Along with the first plant, which is in commercial operation, a second plant with the size of an annual production capacity of 340 mil. m2 is currently under construction with a commercial start date of 2023. The third and fourth plants, each with a capacity of 430 mil. m2, began construction last July. It is anticipated that SKIET’s global production capacity, which includes South Korea, China, and Europe, will reach a total of 2,730 mil. m2.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin