Trends & Reports

Trends & Reports

As the demand for Para-Xylene (“PX”)* products, which is said to be the best player in the petrochemical industry, is showing a recovery trend, the Korean petrochemical industry’s earnings are expected to rebound in the first quarter this year.

(*)Para-Xylene: A petrochemical product made by refining heavy naphtha from crude oil and is used as a raw material for PTA (Purified Terephthalic Acid). PTA is a raw material for polyester that is widely used in clothing and plastic bottles.

According to the industry, as natural cotton product prices, an indicator of global economic recovery, have recently soared high, demand for polyester, a substitute for cotton, is increasing significantly. This is because, as the global price of natural cotton, which is used to extract cotton fibers, soared, the fast fashion industry is turning to polyester, an alternative to cotton fibers.

As such, the increase in demand for polyester resulting from the rise in cotton prices is evaluated to be a good subject for the petrochemical industry in that it drives up the price of petrochemical products that are raw materials for polyester, such as PX products and PTA products.

In this regard, Yoon Jae-sung, an analyst of Hana Financial Investment said in a report on February 21st that, “The prices of PTA and PX products have been recently showing uptrend because global cotton prices have reached the highest level in the past two and a half years.”

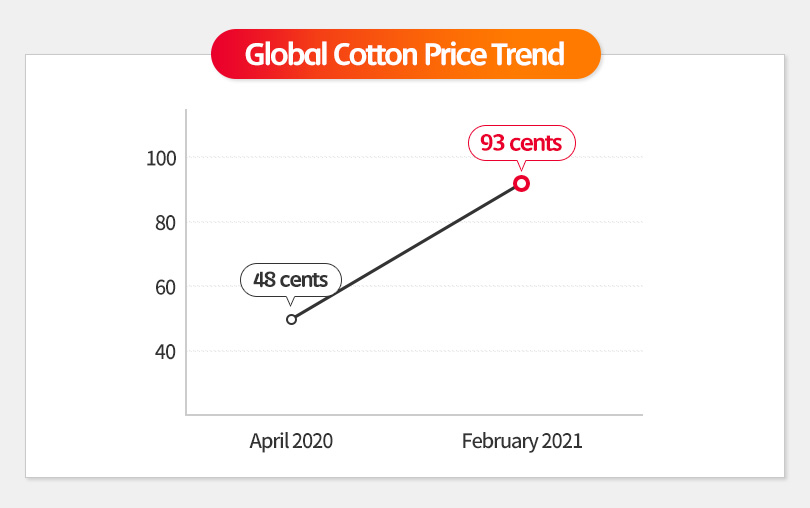

In fact, global cotton prices have risen steadily since September 2020 as demand for clothing increased in anticipation of the recovery after COVID-19, along with the shortage of cotton supply following the U.S. ban on imports of Chinese cotton. According to related industries, global cotton prices have soared from 48 cents per pound, which was the lowest in the last 10 years in April of last year, to 93 cents per pound as of February 24th this year.

Besides, as the production facilities for polyester and PTA products in China are increasing in recent years, the petrochemical industry predicts that PTA products’ market improvement, which is a raw material for PTA products, will accelerate further.

This year’s new PTA production capacity is 16 million tons, and the total production capacity of new polyester plants in China, which is scheduled to be completed this year, is 5.3 million tons. Also, it is expected to be expanded to 5.7 million tons in 2022 and 6.5 million tons in 2023.

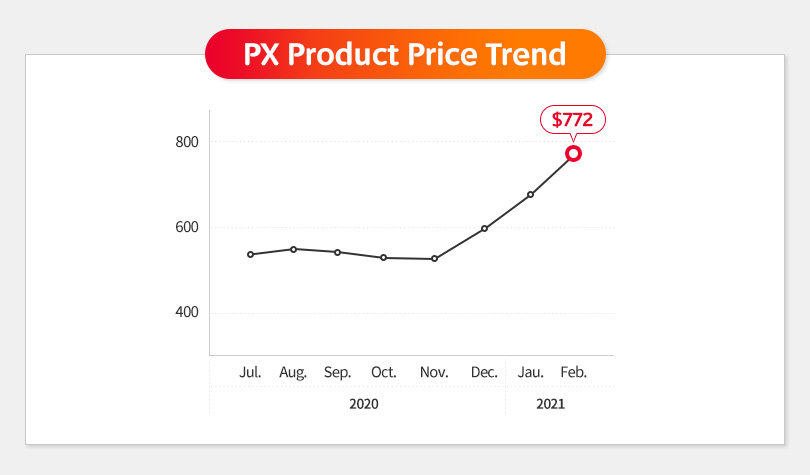

In the industry, the recent PX product price recovery is remarkable. The PX product market has not escaped from the decline for more than a year due to PX products’ oversupply from China and sluggish petrochemical product demand due to the global economic recession.

In February, the average price of PX products was about $772 per ton, increased more than $300 from the lowest monthly average price of $465 last year. The PX spread (PX product price-naphtha price), a measure of PX product performance, has recovered to an average of $210 in February this year after falling to $149 per ton in August of last year. According to the petrochemical industry, the breakeven point for PX products is around $200.

In a report published on December 18th of last year, Baek Young-chan, an analyst of KB Securities predicted that “the price of PX products in December has re-entered the range of $600 after 9 months, and the demand for PX products will increase further from this year” and diagnosed, “The Korean oil refineries and petrochemical companies that produces PX products are expected to improve their earnings in the first quarter of 2021.”

Meanwhile, Korean oil refining and petrochemical industries produce about 10 million tons of PX products annually. Among them, SK Innovation is producing PX products with an annual capacity of 2.9 million tons through its subsidiaries SK Global Chemical and SK Incheon Petrochem. This volume of capacity is the largest in Korea and the sixth in the world.

An official from the petrochemical industry predicted, “Amid the global economic recovery this year, SK Innovation will be able to shift to a surplus from the first quarter based on increased demand for petroleum products, including an improvement in the PX market.”

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin