Trends & Reports

Trends & Reports

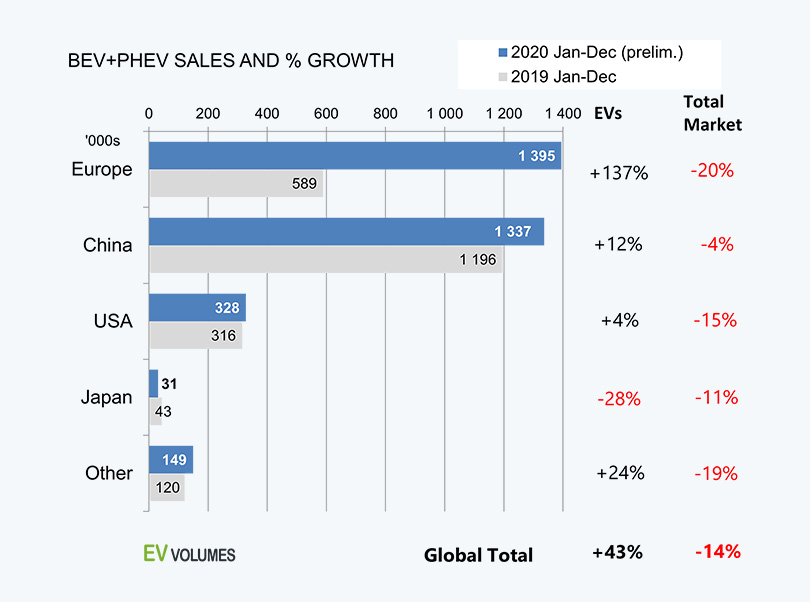

According to the numbers given by EV Volumes, a database of sales statistics, charging infrastructure, batteries, car models, and sales forecasts for plug-in car, last year’s sales of global plug-in vehicles, including BEVs (battery electric vehicles) and PHEV (plug-in hybrid electric vehicles), were estimated to reach 3.24 million units. Compared to the 2.26 million units of year 2019, this is a great increase despite the overall downturn of world’s economy due to the COVID-19.

As climate change is a big threat to not one or a few regions but every country on the globe and governments’ stronger actions to reduce CO2 emission, let’s take a look at the whole picture of EVs sales and growth in the top, the runner-up and potential markets last year.

| China, USA, Europe – the leading markets of electric mobility

China, USA, and Europe has been well known as the three largest markets for electric mobility for a while. Last year, these top 3 still dominated the chart, but there were some notable changes in the growth rates of each market.

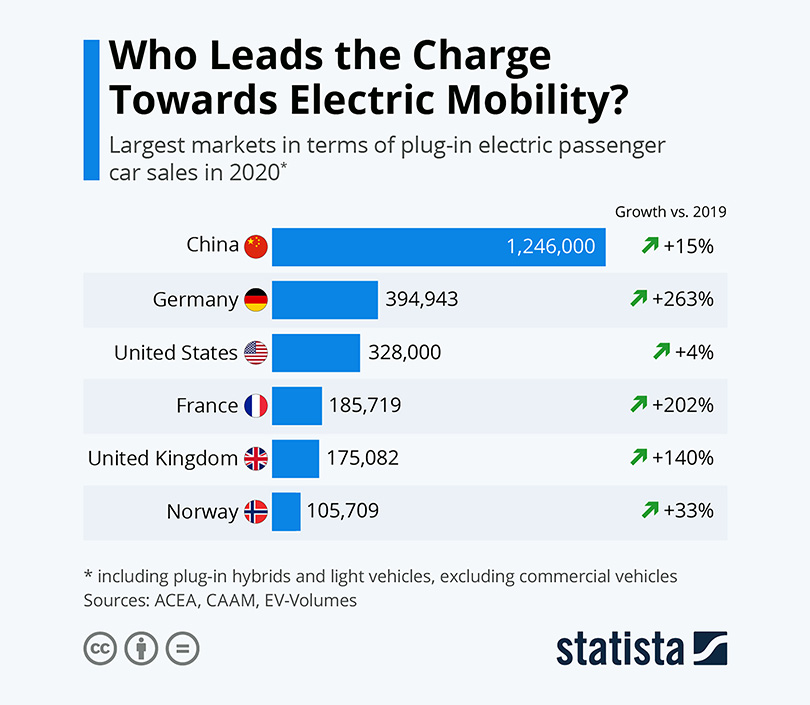

(Source: Statista, http://www.statista.com/chart/13143/electric-vehicle-sales/ )

A chart released on February 16th by Statista, a German company specializing in market and consumer data, showed that in 2020 China stayed firm as the largest EV market with a 19% growth compared to the previous year. Meanwhile, plug-in sales in the U.S. only increased by 4% compared to 2019, even though USA was the third largest EV market in the world, based on EV Volumes’ data.

The strongest growth happened in the Europe. Europe’s total sales of EV has surpassed China with some countries having three-digit percentage of growth over a year, such as Germany, France and the U.K. In particular, Germany has become the second largest EV market (as a single nation). On the other hand, as mentioned in our previous post, Norway is the first country in the world that EVs sales took more than 50% of car sales market share in 2020.

| The up and down in other potential EV markets

On the other hand, unlike the generally growing trend of the trio China, Europe and USA, other markets for EVs including Australia, Canada, Japan, South Korea, and Taiwan showed two different pictures.

On the bright side, according to the same report by EV Volumes, with about 7,000 units sold in 2020 (+308% growth compared to 2019), Taiwan’s EV market has been growing very fast. South Korea also saw a positive sign in its green mobility market. The country ranked the 14th in the world’s chart with 58,000 units sold last year, a 50% of increase compared to 2019’s sales.

(Source: EV Volumes, http://www.ev-volumes.com/country/total-world-plug-in-vehicle-volumes/)

However, EV sales saw a drop in Japan, Canada and Australia.

In Japan, as the country “is lagging behind other countries in making EVs the norm,” according to Jiji Press, the Japanese government is taking more powerful actions to catch up in the race of green vehicles. Recently, Environment Ministry has doubled the subsidies for purchasing BEVs, PHEVs. In December last year, Japan also announced the country was considering ban sales of new inner combustion autos (ICVs) within the mid-2030s to be able to achieve carbon neutrality by 2050.

EV sales in Canada last year also declined with about 47,000 units sold and minus 7% growth compared to 2019. Previously, Transport Canada, a department within the Government of Canada had set targets to have 10% of all light-duty cars be electric by 2025 but with the current 3.5% of EVs penetration, it would be a big challenge for the country to be on track. However, an article on The New York Times a week ago revealed that “A series of announcements has […] set it on the path to electrification,” and thus Canada is ready to “catch up in the race to produce zero-emission vehicles” as the title suggested.

| Southeast Asia and India are eager at the starting line for EV race

As a matter of fact that two-wheel vehicles are still dominating the mobility market in Southeast Asia, unlike the Western countries, e-bikes are growing faster than e-cars in this reason. However, with fast increase of income and large population, promising strong purchasing power in the near future, the Southeast Asia’s markets for green vehicles cannot be ignored.

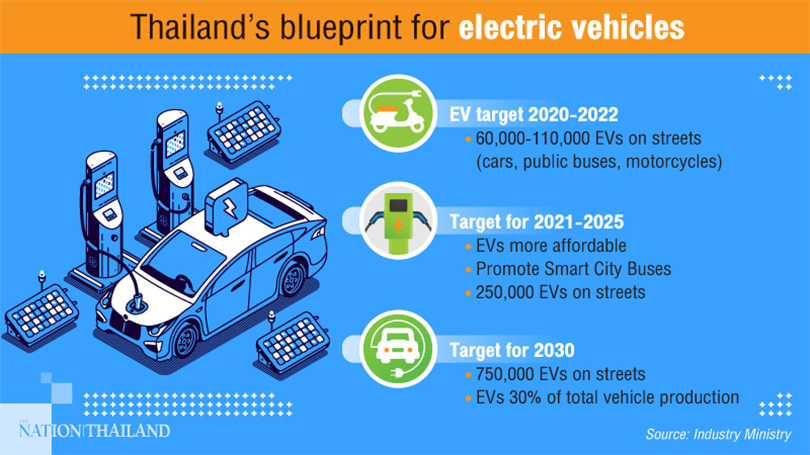

Thailand was among one of the first nation in Southeast Asia to take action in promoting EV usage. Even though EVs are not quite popular yet in the country, the Thai government aims to increase the number of PHEV and BEV to 1.2 million units by 2036. In early 2020, the National Electric Vehicle Policy Committee of Thailand was established to accelerate the country’s national EV roadmap with the goal of manufacturing 250,000 EVs and creating an ASEAN EV hub by 2025. Last year, The Thailand Board of Investment also issued its latest tax incentives for the country’s EV industry.

(Source: The Nation Thailand, https://www.nationthailand.com/auto/30395790)

According to various reports, Indonesia also aims to be an EV hub in Southeast Asia. In August 2019, Indonesian President Joko Widodo issued a Presidential Regulation on the promotion of battery-powered road vehicles, setting a legal framework for the future of EV market in the country. The Indonesian authorities also plans to start the production of EVs in 2022, targeting EVs to reach a 20% share of total production by 2025.

In December 2020, The Economic Times, an English-language business-focused daily newspaper in India, quoted from a report by India Energy Storage Alliance (IESA) that “In the base case scenario, the EV market [of India] is expected to grow at CAGR of 44% between 2020 – 2027, and is expected to hit 6.34-million-unit annual sales by 2027.” The report added, ” The [Indian] industry believes that the market will grow very rapidly in the upcoming years as many state governments are planning to convert the existing fleet of autos into electric under their EV policies.”

Even though EV penetration rate are still very low Southeast Asia and India, a study named “Future of Electric Vehicles in Southeast Asia” in 2018 commissioned by Nissan and carried out by business consulting firm, Frost & Sullivan, revealed that a third of Southeast Asian consumers are open to purchasing an electric car. Maybe in the next decade, the race for electric mobility will also include countries in this region.

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin