SK Innovation

SK Innovation

SK Innovation speeding up Deep Chage 2.0 has issued another momentous decision in its drive to establish its future growth drivers since its decision to invest in a new battery plant in Georgia, United States, last January, while taking part in the Consumer Electronics Show (CES) 2019 as the first of its kind.

The board meeting on February 27 decided upon the investment of a second battery plant in Europe (Komárom, Hungary) and the split-off of its material business as a bid to enhance its competitiveness in new business areas.

This move is interpreted as an effort for the global expansion of its battery business, which the company has focused on in promotion, and the further establishment of the fundamental competitiveness of its material business by creating the basis for its independent management to prepare for its rapid growth in the future.

01│ SK Innovation decides to invest in a second battery plant in Europe, the largest market for EV

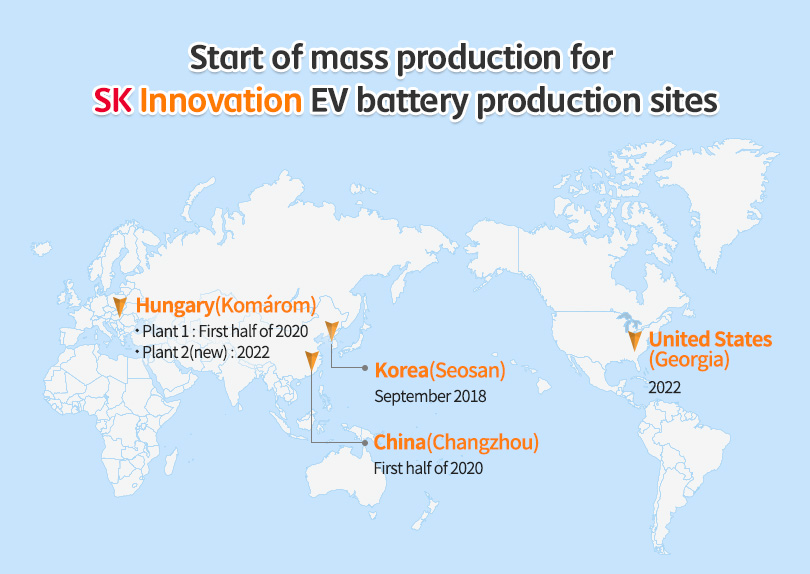

SK Innovation has decided to allocate an investment of KRW 945.2 billion to establish a second battery plant in Europe. This investment will bring up the total of SK Innovation’s electric vehicle (EV) battery production facilities to five: one in Seosan, Korea; one in China; one in the United States; and two in Europe.

The facilities for the second battery plant will be established over a total area of 116,000 m2 within the grounds of the first battery plant—the construction of which began in the city of Komárom, Hungary, last March. SK Innovation has already acquired a plot of land reaching 430,000 m2 in total, about the size of 60 football fields, for the construction of its European battery plant.

Along with the first plant’s 7.5 GWh capacity—the construction of which began early last year with its mass production beginning early next year—construction of the second plant will begin this March and is expected to be completed within the first half of 2020. After pilot runs, a facility check, and product certifications, the plant is expected to enter mass production by early 2022.

Europe has led the world in the transition to EVs. The decision by SK Innovation to establish another production site in Europe follows the need to meet this rapidly growing market head-on and to provide a proactive response to the changes in the market. The completion of the second plant will more than double the production capacity of SK Innovation in Europe beyond the capacity of the first plant.

▲ Aerial view of the Komárom plant (first)

This brings up SK Innovation’s global production capability to that of a global contender by the end of 2021, backed by Seosan Plant (4.7 GWh/year), Komárom Plant (7.5 GWh/year), Changzhou Plant (7.5G Wh/year), and Georgia Plant (9.8 GWh/year).

This will bring the company one step closer to the mid- to long-term goal of the company—a “60 GWh production capacity by 2022 and a global leader in EV batteries,” as announced by CEO & President Kim Jun in CES 2019.

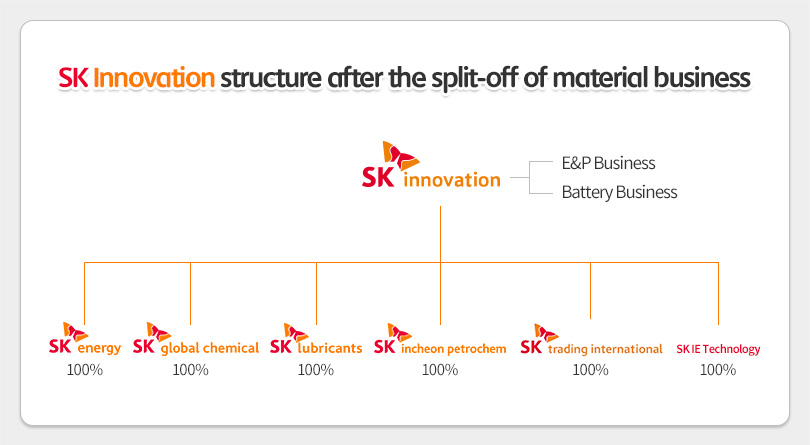

02│ SK Innovation splits off the fastest growing material business for independent management

SK Innovation has also decided to split off its material business into an affiliate through physical and simple division, thereby building the competency of the business in line with its role as the center of the company’s future growth. This split-off will be finalized in a general meeting this March and implemented with April 1 as the deadline.

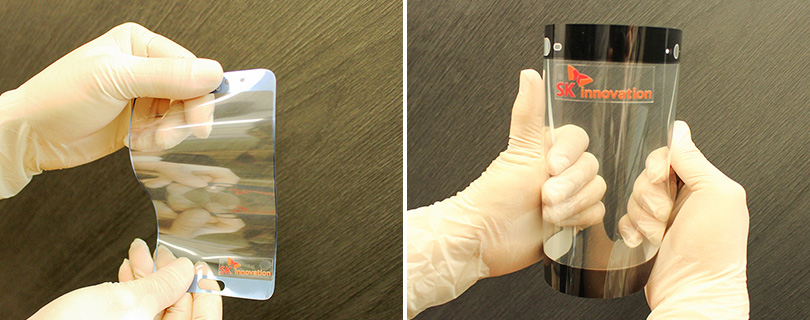

SK Innovation’s material business consists of its Lithium-ion Battery Separator (LiBS) business and the foldable, flexible, rollable display film Flexible Cover Window (FCW). Once finalized, the two businesses will be transferred to the new company. SK’s LiBS business is renowned for having one of the best technological prowess in the market as the second-largest producer in the world. FCW’s debut in CES 2019 has raised great interest throughout the industry as well.

*FCW: A transparent PI film brand and a core component of foldable displays

▲ FCW, a core component of flexible displays developed by SK Innovation. There are no stress marks or folds on the film, even after multiple folding.

This split-off was motivated by the need to establish an independent management system of SK IE Material (tentative name) for the company to respond more effectively to the changes in the management environment, and, thus, build up the group’s expertise in material business even further.

LiBS business already has 11 production lines in Korea’s Jeungpyeong Plant. Construction of a new plant in Changzhou, China, began in the second half of last year with additional production facilities scheduled down the road. Mass production of FCW will begin this March in Daejeon’s Institute of Technology Innovation. Completion of the Jeungpyeong Plant in the second half of this year will start the mass production of FCW in the plant as well.

Once the split-off is decided in a general meeting this March, SK Innovation expects to acquire more flexibility in its business portfolio, which will allow the company to respond more strategically in changes in the management environment. Furthermore, the increasing synergy between the two companies is expected to raise the corporate value of other SK Innovation affiliates as well.

Once the split-off is complete, the new affiliate will bring SK Innovation’s affiliate count to six in total, along with SK Energy, SK Global Chemical, SK Lubricants, SK Incheon Petrochem, and SK Trading International.

| Year |

Event |

| Early 2005 |

Development of EV battery begins in earnest |

| October 2009 |

Selected as the supplier of hybrid battery to Mitsubishi Fuso, under Daimler Group |

| March 2010 |

Selected as the battery supplier in the national project with Hyundai Motor Company, “Commercialization of Small-sized Electric Vehicles” |

| July 2010 |

Selected as the battery supplier for the first mass production of high-speed EVs by Hyundai/Kia |

| July 2010 |

Memorandum of understanding (MOU) signed with the City of Seosan, Chungcheongnam-do Province, for the expansion of the battery production line within Seosan General Industrial Complex |

| January 2011 |

Selected as the battery supplier to Mercedes-AMG’s high-end electric sports cars |

| May 2011 |

Start of construction for the battery production line within Seosan General Industrial Complex in Seosan, Chungcheongnam-do Province |

| May 2012 |

Mitsubishi Fuso, under Daimler Group, launches hybrid truck “Canter Eco Hybrid” |

| July 2012 |

MOU signed with Kia Motors for the development and distribution of EVs |

| September 2012 |

Mass production starts in Seosan battery plant |

| December 2013 |

Beijing BESK Technology (a joint venture with Beijing Electronics Holding and BAIC Motor Corp.) |

| April 2014 |

Kia Motors launches “Soul EV” |

| October 2014 |

BAIC Motor Corp. EV “ES210 (Shenbao)” selected as the official vehicle in the 2014 Asia-Pacific Economic Cooperation (APEC) summit |

| July 2015 |

Expansions of Seosan plant complete (900 MWh capacity) |

| February 2016 |

Selected as the battery supplier for the Mercedes-Benz EV project |

| September 2016 |

Expansion of the 3rd production line in Seosan plant complete (total capacity at 1.1 GWh) |

| 1Q 2018 |

Expansions of the 4th, 5th, and 6th production lines in Seosan plant complete (total capacity at 3.9 GWh) |

| February 2018 |

Construction started for Komárom Plant, Hungary (7.5 GWh) |

| August 2018 |

Construction started for Changzhou Plant through a joint venture with Beijing Electronics Holding and BAIC Motor Corp. (7.5 GWh) |

| August 2018 |

Expansions of the 7th production line in Seosan plant complete (total capacity at 4.7 GWh) |

| February 2019 |

Construction started for Georgia Plant, United States (9.8 GWh) |

| February 2019 |

Investments announced for the 2nd battery plant in Komárom, Hungary |

Youtube

Youtube Facebook

Facebook Instagram

Instagram Linkedin

Linkedin